In a Market Intel update issued in February by American Farm Bureau Federation Economist Daniel Munch, “Hurricanes, Heat and Hardship: Counting 2024’s Crop Losses,” Munch includes data and analysis from AFBF and the National Oceanic and Atmospheric Administration (NOAA).

In sharing the total crop loss estimates across major weather events for 2024, he notes that AFBF has calculated crop and rangeland damage estimates since 2021 in order to provide a window into the impacts of natural disasters on domestic food production. In his overview, Munch says the updated 2024 crop and rangeland damage estimates highlight the devastating impact of natural disasters on U.S. farm production, and reported the following:

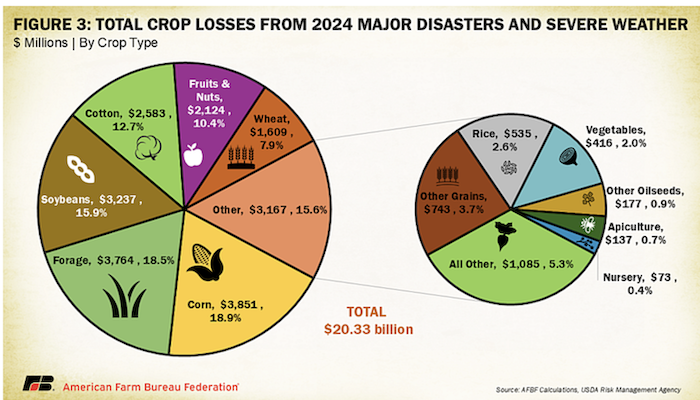

- Total losses to crops and rangeland (including apiculture) from major 2024 weather and fire events exceeded $20.3 billion, accounting for 11.1% of NOAA’s total economic impact from disasters.

- Of this total, $10.9 billion in losses were covered by Risk Management Agency (RMA) programs as of February 2024, while approximately $9.4 billion remained uninsured, fell outside policy coverage limits, or did not qualify under existing risk management programs.

“In 2024, 27 weather disasters, each with damages exceeding $1 billion, struck the U.S. coast-to-coast,” the author says. “The National Oceanic and Atmospheric Administration (NOAA) reported that 2024 ranked fourth in terms of the total inflation-adjusted economic impact of these events, with industries across the economy experiencing an estimated $182.7 billion hit (compared to $92.9 billion in 2023). With nearly 570 lives lost, these disasters will haunt impacted communities for years to come.”

In a deep-dive overview of impacts of weather across the country last year, Munch also noted that AFBF crop loss estimates do not include infrastructure damage, livestock losses (besides apiculture), complete horticulture crop losses or timber losses associated with the selected causes of loss. He also specified that while AFBF has been conducting this analysis since 2021, AFBF’s methodologies changed between 2023 and 2024 to cover more causes-of-loss types. Therefore, he says, totals between years are not directly comparable. A detailed summary of methodology was offered in the Market Intel report.

An American Farm Bureau Federation Market Intel report issued last month offers details on the impact of weather-related disasters and cost to farmers across the U.S. in 2024. Source: AFBF Calculations, USDA Risk Management Agency

Notably, the report on weather impacts on farms and farmers also identified additional factors which contributed to significant crop losses, many Munch notes were exacerbated by challenging weather conditions and are only partially reflected in RMA data.

According to the updated crop loss estimates from AFBF, “At least $43 million was lost to insects, $34 million to plant diseases, $24 million to wildlife and $19 million — primarily in wheat — was lost due to mycotoxins, toxins produced by fungi and other molds.” The author also says, “However, these figures vastly underestimate the true extent of losses due to insurance coverage limitations, exclusions and reporting challenges. Many federal crop insurance policies do not cover wildlife damage unless explicitly included, and even when coverage exists, indemnities may be capped or denied if the loss is deemed preventable … As a result, these figures are likely to represent only a fraction of the total economic impact of these additional loss factors.”

Key Findings by Crop Type

In reporting on losses by crop type, Munch’s analysis included a snapshot of what weather created the worst impacts in key areas of the country.

- Flooding and excessive precipitation across the Upper Midwest, combined with corn’s dominant role in U.S. agriculture, kept corn losses at the top, totaling $3.85 billion in 2024.

- Forage losses ranked second, reaching $3.8 billion, driven primarily by widespread drought conditions in states such as Texas, South Dakota, Kansas and Oklahoma.

- Soybeans followed in third, with $3.2 billion in losses, largely due to the same flood-induced conditions that impacted corn.

- Cotton ranked fourth, with $2.5 billion in losses, primarily attributed to drought in Texas and Oklahoma and hurricane-related damage across the Southeast.

Range of Weather Events and Impacts: Drought, Flooding, Hurricanes

Despite the widespread impact of flooding and hurricanes throughout 2024, drought and heat-related conditions — including excessive heat, prolonged sun exposure, hot wind and wildfires — accounted for the largest share of total crop losses, reaching over $11 billion. Of this amount, $5.3 billion (47%) was covered by RMA insurance policies, while $5.7 billion (53%) fell outside of coverage.

The analysis also noted that “While drought wasn’t as dominant a concern as in previous years, it remained a significant challenge, particularly in late September and October, when more than 27% of the country was classified under severe (D2) drought or worse.”

Flooding was a major issue in 2024, made evident by the following findings from Munch in the comprehensive crop loss assessment: “Record flooding across the Upper Midwest and horrific hurricanes across the Southeast drove much of the year’s agricultural natural disaster-related news cycle. When combined with the numerous other torrential rain and severe storms across the country these causes resulted in $6.7 billion in crop losses.”

“The 2024 hurricane season was one of the most destructive in U.S. history, with severe consequences for farmers, rural communities and agricultural supply chains,” says Munch.

“Hurricanes Helene and Milton devastated the Southeast in September and October, respectively, claiming at least 251 lives and destroying hundreds of homes and vital infrastructure,” he writes, adding: “NOAA estimated total economic damages of Hurricane Helene at $78.7 billion and Hurricane Helene at $34.3 billion. When combined with the economic toll of hurricanes Francine, Debby and Beryl, the 2024 hurricane season inflicted over $124 billion in total losses — accounting for 68% of NOAA’s total 2024-billion-dollar weather disaster damages estimate.”

Hardest Hit States

Munch offered a deep dive into hurricane-related losses. What follows are excerpts of his summary of impacts and the difficulty faced when analyzing claims. Much says that isolating individual hurricane-related losses is challenging, as many claims were reported within the same months and under broader cause-of-loss categories, and shares several state highlights:

Across the Southeast, at least $3 billion in crop production was lost. An important reminder, says Munch, is that this figure excludes damages to infrastructure, equipment, timber and livestock, meaning total agricultural impacts are far greater.

In Georgia, Hurricane Helene alone caused over $195 million in peanut losses, $164 million in cotton, $51 million in pecans and $49 million in blueberries, according to the AFBF report.

In Florida, hurricanes destroyed $155 million in peppers, $50 million in nursery crops, $48 million in peanuts, $42 million in sugarcane, $40 million in fresh market tomatoes and over $7 million in strawberries.

Louisiana bore the brunt of Hurricane Francine, leading to $141 million in sugarcane losses, $78 million in rice and $70 million in soybeans.

In North Carolina, Hurricane Helene wiped out $151 million in flue-cured tobacco, $13 million in blueberries and $10 million in apples.

In South Carolina and Tennessee, corn, cotton and soybeans suffered the most damage, while Virginia saw $9.6 million in tobacco losses.

Texas also faced extensive agricultural losses, with these causes contributing to $227 million in cotton losses, $108 million in corn and $91 million in rice losses.

About AFBF and Market Intel

The American Farm Bureau Federation defines itself as the national advocate for farmers, ranchers and rural communities. The organization, based in Washington, D.C., notes that every year, Farm Bureau members in more than 2,800 counties meet to discuss and vote on policies affecting their farms, ranches and communities. Those policies then set the agenda for their state Farm Bureaus and ultimately AFBF.

Munch, who authors the AFBF Market Intel reports, worked as a protein crop market commodity analyst prior to joining the American Farm Bureau Federation as an Economist. His areas of expertise include dairy markets and policy, disaster programs, transportation and infrastructure and a wide range of specialty crops. Munch is a graduate of the University of Connecticut and has earned a Master of Science in Agricultural and Food Economics from Cornell University. Heavily involved in Northeast agriculture and an active 4-H member in his youth, he now focuses and regularly reports on issues impacting AFBF members.