Outdoor power equipment (OPE) manufacturers improved their year-over year dealer satisfaction scores in 2024. The 73% satisfaction rate tied shortline equipment as the best among the four categories studied by NAEDA (full-line, tractors, OPE and shortline manufacturers). Only 12% of OPE dealers expressed dissatisfaction, compared to 11% for shortlines. The OPE score is a staggering distance from the 24% and 28% marks in dissatisfaction for full-line and tractor manufacturers, respectively.

In the 2024 survey, all OPE categories were higher than last year’s except 4: parts quality, product technical support, warranty payments and warranty procedures.

What Dealers Value Most

Ag Equipment Intelligence grouped the NAEDA data together by what was reported to be “Very Important” or “Fairly Important.” While product quality and parts availability remained unchanged as the no. 1 and 2 categories, the 2024 survey showed that parts quality, manufacturer responsiveness and product technical support moved up to round out the 5 most important characteristics. Showing how different the business conditions have become, product availability was the no. 3 concerns in 2023, but it dropped to no. 7 in 2024.

The areas that dealers valued most are:

- Product Quality: 95%

- Parts Availability: 93%

- Parts Quality: 92%

- Manufacturer Response to Dealer Needs/Concerns: 92%

- Product Technical Support: 91%

- Warranty Payments: 88%

- Product Availability: 87%

- Warranty Procedures: 86%

- Communication with Management: 84%

- Marketing & Advertising Support: 74%

- Return Privileges: 72%

Company by Company Results

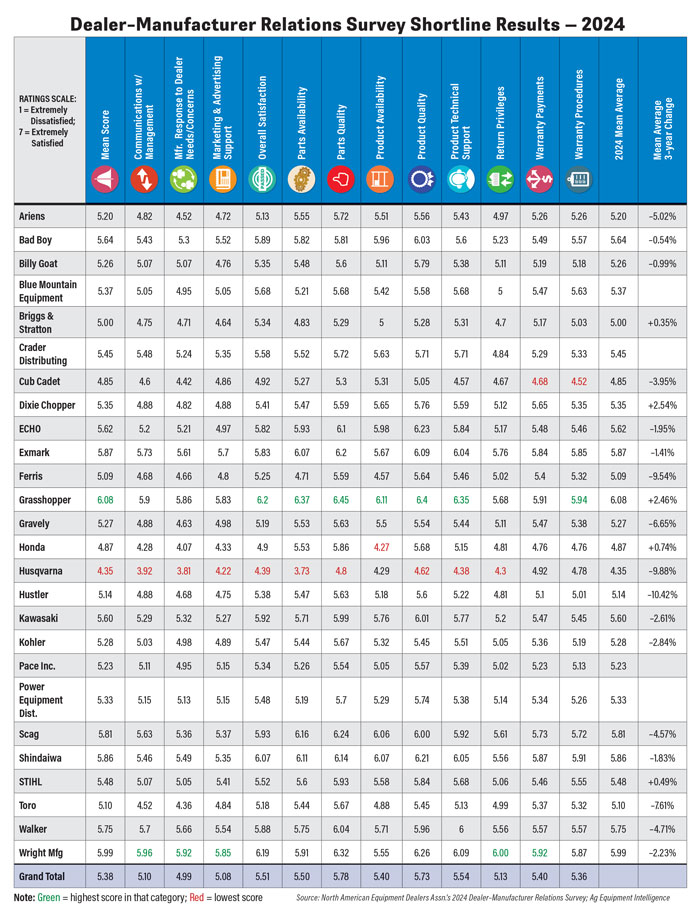

As seen in Table 1, 2 OPE manufacturers dominated dealers’ rankings. Grasshopper led all OEMs in 8 categories, while Wright Mfg. took the top position in 5.

Meanwhile 3 manufacturers sit at the bottom of dealers’ rankings. Husqvarna had the worst scores in 10 categories, while Cub Cadet had 2. Honda also notched a worst-place finish.

Grasshopper: Consistency is Key

For the past 10 years, including 2024, Grasshopper has consistently appeared among the Top 5 list of OPE manufacturers in the annual NAEDA Dealer-Manufacturer Relations Survey. This points to a key aspect of our company's ethos: consistency. The past several years has seen a number of mergers, acquisitions and leadership changes in the OPE industry; many which brought uncertainty for OPE dealers. But for 67 years, Grasshopper continues to be family owned and operated. We continue to build our mowers to last years decades and generations — which is evidenced by our top marks in the products- and parts-related categories in the 2024 results.

We take the same approach to building relationships with our dealers as we do to building our mowers: we’re in it for the long haul. Overall, the consistency we provide in company stability, product quality, product longevity, product dependability, customer satisfaction, etc. matters a great deal to our dealers. – Michael Simmon, The Grasshopper Co., Moundridge, Kan.

Following are the manufacturers’ performance in each of the studied categories, in the order of what is important to dealers. The numerical scores are based on a scale of 1 (extremely dissatisfied to 7 (extremely satisfied), while the trending data is expressed in percentage change.

1. Overall Satisfaction

Highest: Grasshopper (6.20), Wright Mfg. (6.19), Scag (5.93)

Trending Up: Ferris (+9.38%), Briggs & Stratton (+8.32%), Walker (+5.38%)

Lowest: Husqvarna (4.39), Honda (4.90), Cub Cadet (4.92)

Trending Down: Dixie Chopper (- 6.24%), Gravely (-5.81%), Cub Cadet (-5.75%)

2. Product Quality

Highest: Grasshopper (6.40), Wright Mfg. (6.26), ECHO (6.23)

Trending Up: Briggs & Stratton (+4.76%), Walker (+3.47%), Kohler (+0.93%)

Lowest: Husqvarna (4.62), Cub Cadet (5.05), Briggs & Stratton (5.28)

Trending Down: Honda (-7.34%), Ariens (-5.76%), Scag (-5.51%)

3. Parts Availability

Highest: Grasshopper (6.37), Scag (6.16), Shindaiwa (6.11)

Trending Up: Walker (+9.73%), Honda (+5.74%), STIHL (+5.46%)

Lowest: Husqvarna (3.73), Ferris (4.71), Briggs & Stratton (4.83)

Trending Down: Bad Boy (-5.21%), Toro (-3.72%), Kawasaki (-1.89%)

4. Parts Quality

Highest: Grasshopper (6.45), Wright Mfg. (6.32), Scag (6.24),

Trending Up: Walker (+4.32%), Briggs & Stratton (+1.34%), Kohler (+0.89%)

Lowest: Husqvarna (4.80), Briggs & Stratton (5.29), Cub Cadet (5.30),

Trending Down: Bad Boy (-6.29%), Husqvarna (-5.70%), Toro (-3.74%)

5. Manufacturer Response to Dealer Needs/Concerns

Highest: Wright Mfg. (5.92), Grasshopper (5.86), Walker (5.66%)

Trending Up: Ferris (+10.95%), Billy Goat (+9.50%), Briggs & Stratton (+7.53%)

Lowest: Husqvarna (3.81), Honda (4.07), Toro (4.36)

Trending Down: Scag (-9.15%), Ariens (-6.42%), Dixie Chopper (-6.41%)

6. Product Technical Support

Highest: Wright Mfg (6.09), Shindaiwa (6.05), Exmark (6.04)

Trending Up: Walker (+6.57%), Wright Mfg. (+3.40%), Briggs & Stratton (+2.91%)

Lowest: Toro (5.13), Honda (5.15), Hustler (5.22)

Trending Down: Husqvarna (-8.75%), Cub Cadet (-7.49%), Dixie Chopper (-5.57%)

7. Warranty Payments

Highest: Wright Mfg. (5.92), Grasshopper (5.91), Shindaiwa (5.87)

Trending Up: Dixie Chopper (+1.99%), Billy Goat (+1.96%), Kohler (+1.90%)

Lowest: Cub Cadet (4.68), Honda (4.76), Husqvama (4.92)

Trending Down: Husqvarna (-6.46%), Toro (-5.95%), Ariens (-4.54%)

8. Product Availability

Highest: Grasshopper (6.11), Shindaiwa (6.07), Scag (6.06)

Trending Up: Ferris (+49.35%), Walker (+38.93%), Billy Goat (+25.55%)

Lowest: Honda (4.27), Husqvarna (4.29), Ferris (4.57)

Trending Down: No declines

9. Warranty Procedures

Highest: Grasshopper (5.94), Shindaiwa (5.91), Wright Mfg. (5.87)

Trending Up: Billy Goat (+5.07%), Kohler (+2.77%), Honda (+2.37%)

Lowest: Cub Cadet (4.52), Honda (4.76), Husqvarna (4.78)

Trending Down: Cub Cadet (-6.22%), Toro (-6.01%), Ariens (-5.23%)

10. Communications with Management

Highest: Wright Mfg. (5.96), Grasshopper (5.90), Exmark (5.73)

Trending Up: Briggs & Stratton (+5.56%), Ferris (+4.93%), Walker (+4.01%)

Lowest: Husqvarna (3.92), Honda (4.28), Toro (4.52)

Trending Down: Scag (-5.70%), Ariens (-4.55%), Toro (-4.24%)

11. Marketing & Advertising Support

Highest: Wright Mfg. (5.85), Exmark (5.70), Walker (5.54)

Trending Up: Briggs & Stratton (+10.21%), Ferris (+8.84%), Walker (+6.74%)

Lowest: Husqvarma (4.22), Honda (4.33), Briggs & Stratton (4.64)

Trending Down: Hustler (-5.19%), Scag (-4.79%), Gravely (-2.35%)

12. Return Privileges

Highest: Wright Mfg. (6.00), Exmark (5.76), Grasshopper (5.68),

Trending Up: Walker (+12.15%), Briggs & Stratton (7.31%), Ferris (+6.81%)

Lowest: Husqvarna (4.30), Cub Cadet (4.67), Briggs & Stratton (4.70),

Trending Down: Wright Mfg. (-100.00%), Ariens (-5.69%), Hustler (-4.94%)

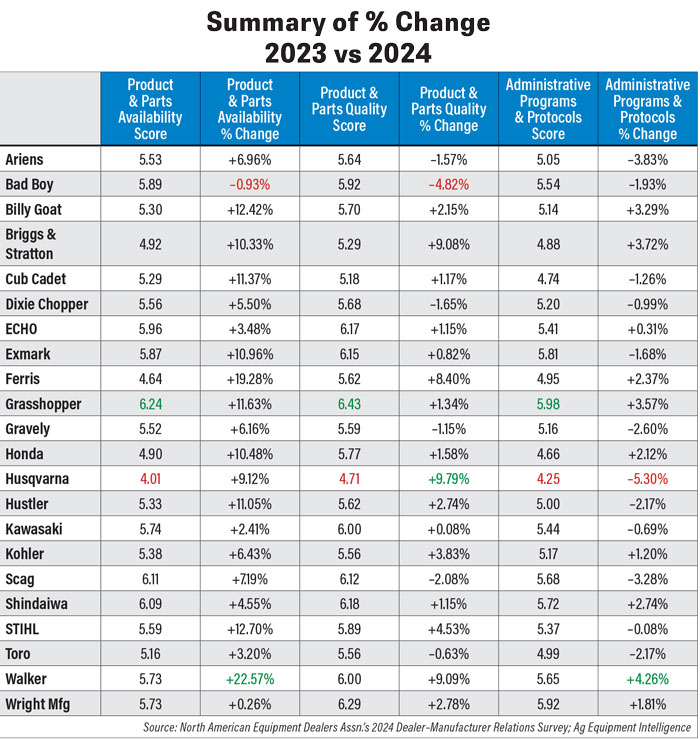

A simplified look at the results is shown in Table 2. It shows a first-ever aggregation of the OPE manufacturers into 3 categories, and their change year-over-year. In these grouped categories, Grasshopper earned the top spot in all three areas – product/parts availability, product and parts quality, and administrative programs/protocols. Shindaiwa earned the second-highest scores in availability and quality, with Wright Mfg. finishing second in the administration and protocols.

OPE Distributors Now Counted in Results

NAEDA included several OPE distributors in the survey for the first time, at the request of Blue Mountain Equipment, Crader Distributing, Pace Inc. and Power Equipment Distributors. “The OPE Dealer Council suggested that distributors be included as, in many cases, they have more direct contact with the dealers when repping the manufacturers,” says Joe Dykes, NAEDA’s vice president of industry relations.

According to Dykes, Blue Mountain and Crader are primarily Stihl distributors, while Pace and Power Equipment Distributors carry various lines, such as Scag, Ferris, Exmark, Toro and Wright. Crader Distributing had the highest average mean at 5.45 followed by Blue Mountain Equipment, (5.37),Power Equipment Distributors (5.33) and Pace Inc. (5.23)

In terms of most improved year-over-year, Walker’s scores increased 22.57% in availability and 4.26% increase in administration. Despite having low scores, Husqvarna actually had the largest increase year-over-year in product/parts quality.

Ag Equipment Intelligence’s historical data tables also shed light to those manufacturers “on the rise.” Walker improved in every single category vs. their 2023 figures, with three manufacturers tied for the second most performance. Grasshopper, Ferris and Briggs & Stratton grew in all but one category in 2024 – in overall satisfaction (0.32%), parts availability (-0.21%) and warranty procedures (-1.18%), respectively.

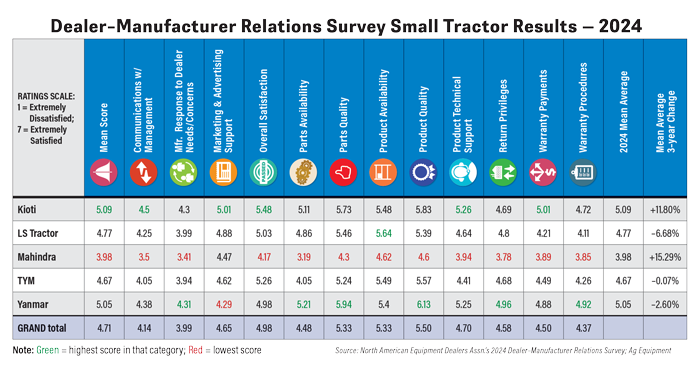

Small-Sized Tractor Performance

When examining the OEMs supplying the smaller power tractors, Kioti took 7 first-place finishes. Yanmar took 5, and LS Tractor took 1.

Meanwhile, Mahindra finished last in every category with the exception of marketing/ad support, in which Yanmar performed the worst.

Yet despite its near last-place scores across the field, Mahindra also had the highest 3-year change in average mean with a 15.29% improvement. Among the average mean scores that fell over the last 3 years, LS Tractor had the biggest drop at -6.68%.

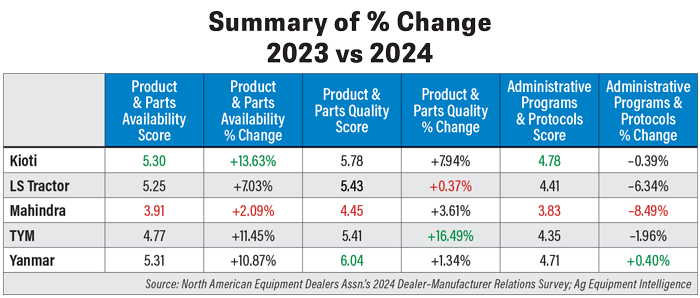

Grouped Analysis.The grouped analysis showed the same thing. Kioti had the best performance in product/parts availability and administrative programs/protocols. (Interestingly, all tractor OEMs went backwards in this category from 2023 to 2024.) And LS Tractor had the smallest product/parts quality score among the small tractor segment, yet still saw an improvement at +0.37%).

TYM notched the best improvement in the products/parts quality, improving 16.49% vs. last year, while Yanmar made the biggest improvement in administrative programs/protocols at a modest 0.40%.

2024 NAEDA Dealer-Manufacturer Relations Report

The 2024 Dealer-Manufacturer Relations Report is available to all NAEDA dealer members and to participating manufacturers. For information, contact Joe Dykes at jdykes@equipmentdealer.org