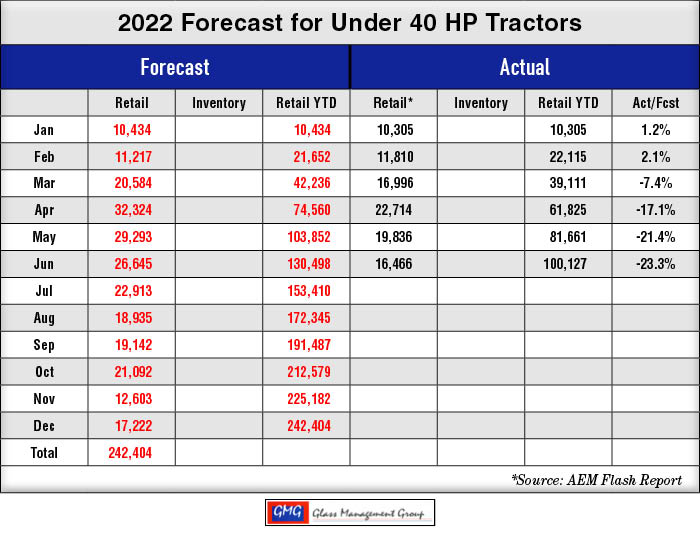

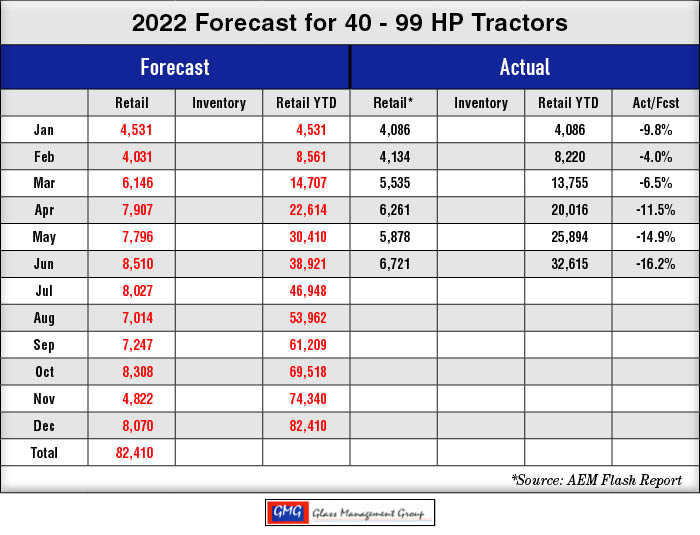

Our data base for tractor retail sales and field inventory is derived from AEM’s monthly Flash Reports.

Under 40 Horsepower Tractors – Retail sales for these small tractors was off in June and is reflective of the inflationary pressure in the general economy.

40-99 Horsepower Tractors – These tractors showed the strongest retail sales month this year and are representative of the need to replace aging equipment in the on farm fleet.

The prospect of continued growth in inflation within the U.S. general economy should be viewed as a negative for future farm equipment sales. During the past two years individual bank account balances had grown to great heights but the current increases in prices for all products has reduced those bank balances for many individuals. Farmers are certainly conservative purchasers of all products and have demonstrated that trait in their purchasing habit of late. The rising cost of agriculture equipment, much of those increases coming from the added technology, has given rise to second thoughts for many farmers in making purchasing decisions.

This current economic situation is one that is unusual in the sense that unemployment remained very low and employers continued to have difficulty in hiring qualified candidates for their open job position while prices continue to rise. Even though many employees have seen an increase in their incomes, those increases have not kept pace with the rising prices for the item that they purchase daily.

Our forecasting models rely exclusively upon the statistics within the agricultural equipment markets and suggest changes based upon those data. While we will not produce the 2023 forecast until next November, our models are currently suggesting that the U.S tractor and combine markets will most likely be comparable to the sales volume generated in 2022. Current net farm income levels is suggesting that farmers may be more likely to purchase new equipment in the coming months but any downward movement in net farm income will result in declining agricultural equipment sales.

For a complete forecast and analysis of all tractor ranges and combines can be found on Ag Equipment Intelligence.