Cervus Equipment generated $3.2 million in adjusted income before tax, a significant increase of $2.7 million compared to the $0.5 million generated in the first quarter of 2020. This improved performance reflects the Company’s strategic focus on growing product support revenue, as well as lower finance costs associated with decreased inventory levels.

"In what is typically our slowest quarter, I am proud of our team’s successful execution on initiatives to grow parts sales, which increased 11% in the quarter, driving a 7% increase in overall product support revenue,” said Angela Lekatsas, president and CEO of Cervus. "Despite a decrease in equipment and service revenues from continued impacts of the global pandemic, we achieved a 5% increase in gross profit quarter over quarter, from this change in the proportion of revenue from product support.

"Strong industry demand, compounded by supply chain constraints related to the pandemic and severe weather events, impacted the availability and timing of equipment from our manufacturers in the quarter. We expect manufacturer supply chain issues, including semiconductor shortages, may continue into the second and third quarters of the year, and are working in partnership with our manufacturers to minimize the impact to our customers and our business."

First Quarter 2021 Highlights

- The Company reported income of $3.0 million or $0.19 per basic share in the first quarter of 2021, compared to a loss of $2.7 million or ($0.17) per basic share in the first quarter of 2020.

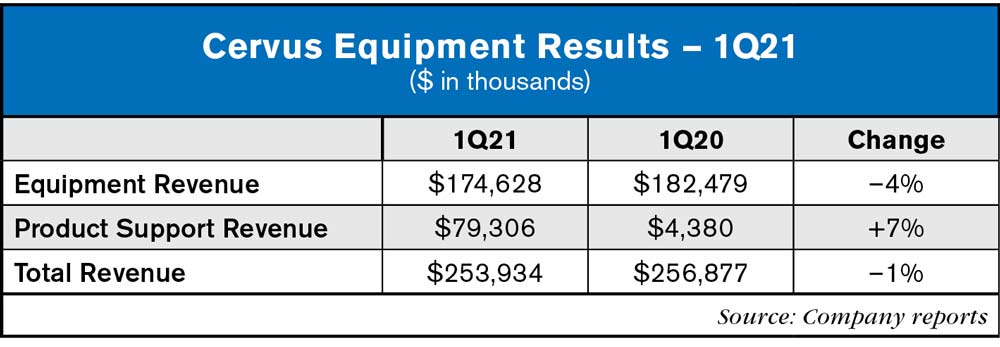

- Total revenue decreased 1% in the quarter, comprised of a 4% decrease in equipment revenue, partly offset by a 7% increase in product support revenue. This change in sales mix resulted in a 5% increase in gross profit.

- A $70 million reduction in total inventory, combined with the repayment of amounts owing under our syndicate and capital facilities in the third quarter of 2020, resulted in a 41% decrease in net finance costs compared to the first quarter of 2020.

- Agriculture used equipment inventory turnover for the trailing twelve-month period ended March 31, 2021, improved to 3.28 times, compared to 1.89 times at March 31, 2020.

- Adjusted free cash flow from operations was $7 million for the three month period ended March 31, 2021 compared to $4.1 million in 2020, an increase of $3.2 million.

First Quarter 2021 Results

Revenue

- Total revenue decreased 1% in the quarter, comprised of a 4% decrease in equipment revenue, partially offset by a 7% increase in product support revenue. The majority of this change was driven by our Agriculture segment.

- Agriculture revenue decreased 1% in the quarter, driven by a 5% decrease in equipment revenue as deliveries were delayed by the manufacturer, compared to the first quarter of 2020, when sales were accelerated by customers in anticipation of currency-driven price increases. The decrease in equipment revenue was partly offset by a 13% increase in product support revenue in the quarter, as we executed on strategic parts initiatives, including online and on the road parts sales, and the addition of two new locations after the first quarter of 2020.

- Transportation revenue decreased 1% in the quarter, driven by a 2% decrease in equipment revenue, resulting from manufacturer production delays due to component part shortages and delays in deliveries from logistics challenges related to COVID-19. The decrease in equipment revenue was partly offset by a 6% increase in parts revenue in the quarter, a result of continued initiatives to market over the counter parts to our customers, including through our on the road sales team.

Gross Profit

- Gross profit increased 5% in the quarter, driven by a 7% improvement in product support revenue, which contributed an additional $1.8 million to gross profit in the quarter compared to 2020. The growth in product support gross profit was largely attributable to increased parts revenue of 11%, partly offset by a decline in service and other revenues of 3%. Gross profit margin as a percent of revenue increased, reflecting the shift in sales mix towards higher margin product support revenue.

G&A Expenses and Net Finance Costs

- G&A expenses, which exclude equipment commissions, increased 1% or $0.2 million in the quarter, driven by the strategic initiatives and new locations in our Agriculture segment discussed above, partly offset by expense reductions in our Transportation and Industrial segments.

- Net finance costs decreased 41% or $1.4 million for the quarter, as we benefited from reduced inventory levels, a reduction in long-term debt, as well as lower interest rates.

Income

- Income before tax increased $8 million, quarter over quarter. In addition to the improvements in gross profit and net finance costs, this variance reflects the inclusion of $1.1 million in government subsidies related to the pandemic in the first quarter of 2021, as well as a $4.0 million decrease in unrealized foreign exchange losses. Adjusted income before tax, which excludes the impact of the subsidies and unrealized foreign exchange, increased $2.7 million for the quarter.

Inventory

- Total inventory decreased $70 million from March 31, 2020, reflecting a $49 million decrease in the Agriculture segment and a $19 million decrease in the Transportation segment. This significant decrease in inventory resulted in Agriculture used equipment turnover for the trailing twelve-month period ended March 31, 2021, improving to 3.28 times from 1.89 times at March 31, 2020, surpassing our long-term used equipment inventory turnover objective of 2.50 times.