Rural equipment dealer confidence had been soaring for 2 years. Then 2020 happened — a year like most had never experienced. Uneven demand. Uncertain supply chains. Rising costs. Make no mistake, 2020 was a year that tested even the most battle-tested equipment dealers.

Many rural lifestyle equipment dealers passed the test with flying colors. With rural lifestylers spending even more time at home due to the pandemic, money historically spent on vacations and other outings was redirected toward home projects and products — including outdoor power equipment.

Outdoor Power Equipment Institute (OPEI) data shows that consumer lawn mower shipments were up 15% in 2020 while handheld products grew 17%. Commercial mower shipments dipped modestly (5%) as many landscape contractors acted cautiously, limiting capital expenditures while wrestling with rising operating costs. A strong rebound is expected this year, though, which will help deliver another healthy-growth year across the power equipment industry.

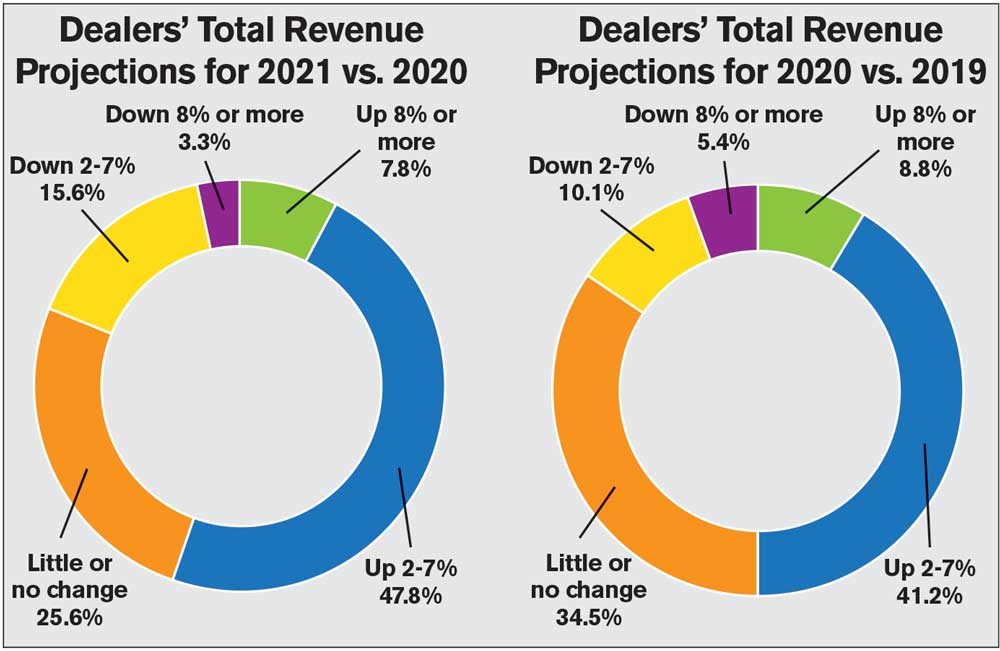

Rural equipment dealers can sense it. According to results from Rural Lifestyle Dealer’s annual Business Trends & Outlook surveys, 85% of dealers expected overall revenue to at least remain flat heading into 2019, and the same percentage felt that way heading into 2020. Now, after an especially strong year in 2020, roughly 81% of dealers expect overall revenue to remain flat or grow this year. Furthermore, more dealers are feeling better about their prospects for growth than last year at this time (see “5-Year Trend for Revenue Growth” below).

Aftermarket parts and service continues to be a big driver of dealership growth. Roughly 93% of dealers think aftermarket sales will at least remain flat this year. In fact, 60% are expecting an increase in sales, which nearly matches the strong 65% recording last year.

Growth in Key Equipment Categories

As pointed out earlier, the COVID culture encouraged more consumers to spend more money on outdoor power equipment in 2020. As dealers try to forecast demand for 2021, “gut instinct” is about as scientific as it gets.

“COVID-19 is not going away in the short-term,” one dealer says. “People will spend their money on mowers and compact tractors in 2021. The travel industry is going to be slow, and it is going to be a long recovery for them. Vacations have become new cars, trucks, mowers and tractors. People will spend their earnings at home.”

Dealer Takeaways

- 82% of dealers expect overall sales to at least remain flat in 2021. Roughly 56% are actually forecasting growth.

- 93% of dealers expect parts and service revenue to at least remain flat in 2021. Roughly 60% are actually forecasting growth.

- At least 30% of dealers forecast growth in 14 key product categories. Leading the way are tractors under 40 hp (61% of dealers) and zero-turn mowers (59% of dealers). “Tractors and mowers have become the new vacations,” one dealer relates.

- 33% of dealers say they are looking to add equipment lines within the next 2 years. That is up 8% from one year ago.

Some dealers are a bit less bullish on the consumer market, speculating that the big pop in spending last year may have left this market segment somewhat deflated.

“We observed a large increase in hobby farm and small livestock customers during COVID,” one dealer says. “I feel like some of the impulse buys from those customers will slow this year.”

“I think we’ll see similar sales to 2019 for consumer products,” another dealer says. “However, farmers are going to have more money to spend because farm income has greatly increased over the past year.”

Regardless of where dealers think demand will come from, unorthodox inventory planning seems to be best practice these days.

“We are ordering double the amount we typically do in the preseason,” one dealer says. “We know there will be major complications in getting product this year.”

“I ordered a 9-month supply of inventory to arrive between December and February,” another dealer shares. “I usually order a 6-month supply. We just need to make sure there is stock rolling into the yard. Our inventory levels are dangerously low.”

Another dealer puts it all into perspective quite succinctly. “You’ve got to have it to sell it.”

The overwhelming majority of dealers expect equipment sales to at least remain flat this year. In fact, there are 14 equipment categories that at least 30% of rural equipment dealers see an opportunity to grow in 2021:

- Tractors under 40 hp – 61% (11% expect 8%+ growth)

- Zero-turn mowers – 59% (15% expect 8%+ growth)

- Front-end loaders – 46%

- Rotary cutters – 46%

- Tractors 40-100 hp – 45%

- Skid-steer loaders – 42% (16% expect 8%+ growth)

- Chain saws – 42%

- Tillers – 40%

- Utility vehicles – 38%

- Hay tools/balers – 34%

- Power hand tools – 34%

- Backhoes – 32%

- Compact excavators – 32%

- Finishing mowers – 30%

Interestingly, lawn tractors narrowly missed the list with 28% of dealers seeing an opportunity for growth in 2021. Even as more rural lifestylers migrate toward zero-turn mowers, there is still a solid market for lawn tractors. But at the same time, 14% of dealers are expecting a lawn tractor sales decrease this year, the most of any category except 40-100 horsepower tractors. It goes to show you that every market is different, and every dealership is different. Rural equipment dealers must continue to understand the unique needs of their customers, and align themselves with manufacturers and products that appeal to those needs.

Tools that Help Fuel Equipment Sales

Rural dealers continue selling equipment, parts and service to a variety of customer segments:

- Hobby farmers and large-property owners – 96% of dealers

- Landscape contractors – 81% of dealers

- Municipalities and parks – 79% of dealers

- Production farmers – 75% of dealers

- Construction contractors – 62% of dealers

Two customer groups in particular are presenting strong opportunity in 2021: rural lifestylers and landscape contractors. Roughly 80% of dealers say the number of customers from these two segments has grown at least 5% over the past 5 years. In fact, roughly 19% of dealers have seen an explosive increase of more than 20%. Only 5% of dealers have seen a decline in the number of rural lifestyle and landscape customers.

Regardless if the customer is commercial or consumer in nature, it pays off for rural equipment dealers to employ experienced and knowledgeable staff that understand each customer’s unique needs.

Roughly 67% of rural equipment dealers have been focused on selling to the rural lifestyle market for at least 16 years. Just 8% are newbies with fewer than 4 years’ experience.

Roughly 74% of dealers take that experience one step further by employing dedicated salespeople for the rural lifestyle market. This strategic staffing move has the potential of being a real game-changer.

Nearly all rural equipment dealers (99%) say their rural lifestyle customers often come into the dealership with some degree of product model or brand preference. In fact, half of dealers say that happens most of the time. However, 40% of dealers say there are numerous occasions where a customer has no preconceived notion of what to purchase.

Here’s where it gets interesting. Roughly 69% of dealers say that a rural lifestyle customer takes the dealer’s product recommendation most of the time. Another 22% say their recommendation is accepted at least some of the time. Roughly 9% of dealers say rural lifestyle customers almost always take their advice.

Financing has become another essential selling tool. Roughly 72% of dealers say financing is requested by the customer on at least half of purchases. In fact, roughly 30% of dealers say financing is requested on over three-fourths of purchases. Only 10% of dealers say financing only comes into play on less than a quarter of purchases.

Stocking the Showroom

The rural lifestyle customer’s willingness to purchase the brand and model a dealer recommends helps explain why most key equipment categories remain heavily saturated. Each category has a couple of clear frontrunners, followed by numerous brands that battle over a large chunk of the market. Dealerships represent the front lines of those battles.

Half of rural equipment dealers carry no more than 5 lines. Roughly 35% carry 6-10 lines, and another 8% carry 11-15. Just 7% of dealers carry 15 or more lines.

Most dealers seem content with their existing brand offering, though there has been some movement toward adding product lines over the past year. According to the results of this year’s survey, roughly 33% of dealers say they expect to add at least one equipment line within the next 2 years. That number was much lower (25%) last year at this time.

Dealers cite 31 product categories where they would like to expand their offerings, ranging from the largest of tractors to the smallest of power tools. There are 11 categories that really stand out, with at least 15% of expansion-minded dealers looking to add to their mix:

- Skid-steer loaders – 46%

- Tractors under 40 hp – 37%

- Utility vehicles – 32%

- Compact excavators – 29%

- Tractors 40-100 hp – 27%

- Zero-turn mowers – 22%

- Hay tools/balers – 17%

- Rotary cutters – 15%

- Tillers – 15%

- Chain saws – 15%

- Power hand tools – 15%

Dealers have options when looking to expand many of the key categories listed above. When asked which brands they offer to rural lifestyle customers, the responses are greatly varied.

Compact Utility Tractors. Dealers identified a total of 18 brands. The most common are Massey Ferguson (26%), Kubota (23%), John Deere (22%) and New Holland (18%).

Sub-Compact Tractors & Lawn Tractors. Dealers identified a total of 17 brands. The most common are Massey Ferguson (26%), John Deere (22%), Kubota (20%), Simplicity (19%) and New Holland (14%).

Zero-Turn Mowers. Dealers identified a total of 27 brands. The most common are Ferris (23%), John Deere (20%), Kubota (20%), Grasshopper (18%), Exmark (16%) and Simplicity (16%).

Utility Vehicles. Dealers identified a total of 21 brands. The most common are Kubota (31%), John Deere (29%), Polaris (10%), Bobcat (8%) and Cub Cadet (8%).

Regardless of what a given dealership’s product mix looks like, 85% of rural equipment dealers say they turn wholegoods inventory no more than 4 times per year. In fact, 44% turn it 1-2 times per year.

Roughly 41% of rural equipment dealers provide rentals — renting everything from large riding equipment to small handheld tools and generators. There are 13 product categories that are the most common, with at least 20% of renting dealers saying they rent them:

- Skid-steer loaders – 69%

- Compact excavators – 63%

- Tractors 40-100 hp – 51%

- Tractors under 40 hp – 40%

- Zero-turn mowers – 29%

- Snow removal equipment – 26%

- Utility vehicles – 23%

- Lawn tractors – 23%

- Front-end loaders – 23%

- Backhoes – 20%

- Seeders/drills – 20%

- Hay tools/balers – 20%

- Tillers – 20%

Service & Profits After the Sale

As important as it is to turn wholegoods inventory, stability in the aftermarket revenue stream is equally vital to a rural equipment dealer. A steady, predictable flow of after-sale business helps bolster overall dealership profitability. It also helps a dealership recruit and retain reliable technicians.

This year’s survey uncovers positive news in this area. Roughly 52% of dealers say parts and service account for 26-50% of total dealership sales. Another 21% say aftermarket revenue is in the 51-75% range. Even those 27% of dealers who say parts and service represent a smaller piece of the pie are likely operating lucrative aftermarket operations. In many instances, the smaller percentage of parts/service business is simply a matter of more equipment being sold through the dealership.

Most dealers (74%) have no more than 10 full-time technicians. In fact, half of dealers have no more than 5.

Nearly half of dealers (49%) say their shop labor rate is in the $76-100 range. Just 10% of dealers are charging less than $75 per hour.

There has been significant movement over the past year with respect to rural equipment dealers charging in excess of $100/hour for service. This year’s survey results show that roughly 41% of dealers fall into this category. Last year at this time, it was only 31%.

“Many dealers have realized that finding good technicians is not cheap,” says Sara Hey, vice president of business development at Bob Clements International. “Regardless of where you are in the country, a good B-level technician won’t work for $15 an hour. Our rule of thumb is that the maximum you can pay a technician is 30% of your posted labor rate.”

More dealers are also recognizing that the cost of tools and training continues to escalate as manufacturers continue bringing new products and innovations to market.

More dealers are requiring the service department to be a profit center, while also understanding the value they bring to their local communities. As a result, dealers are becoming less hesitant to charge for that value.

“A quick way to see if your posted labor rate is where it needs to be is to call the local car dealerships in your area and ask about their posted labor rate — and then be about 10% less,” Hey advises.

Robust and reliable dealership management software plays an important role in helping dealers turn their service departments into profit centers. A good business system will also help with parts department management, wholegoods inventory management, point of sale, customer relationship management and a host of other functions.

Rural equipment dealers look to a variety of sources for their business system needs, with nearly 20 software platforms being referenced in this year’s survey. The most popular are:

- DIS – 22%

- Basic Software – 15%

- HBS – 12%

- Charter Software – 9%

- CDK – 9%

Interestingly, roughly 5% of rural equipment dealers say they are using QuickBooks as their management tool. If basic accounting functions are all you’re after, this might make sense. However, depending on the size and complexity of the operation, a dealer using QuickBooks could miss out on the opportunity to better manage all of those dealership-specific intricacies like technician productivity, parts inventory management, wholegoods aging, etc.

In some instances, the up-front investment required for a robust dealership management system can be a deterrent. If rural equipment dealers were blessed with unlimited resources, 72% say they would invest in ways to modernize the service department. Roughly 53% say they would invest in the retail part of the business. Roughly 37% say they would invest specifically in a business system.

Plenty of Optimism, but It Isn’t Blind

Unfortunately, most rural equipment dealers aren’t blessed with unlimited resources. Most decisions come down to choices — choices based on gut instinct. Most dealers say their gut is telling them that this year will be more like a typical year, as opposed to 2020 when COVID-19 helped fuel additional demand for power equipment. In turn, 67% of dealers are planning inventory more like a typical year.

The unprecedented 2020 election cycle has also preyed on the minds of rural equipment dealers. “I am extremely worried about tax increases, healthcare costs, an increase in the minimum wage, and the possibility of tax reduction tools like Section 179 being eliminated,” one dealer says.

Two issues in particular are of pressing concern for rural equipment dealers this year: finding good employees (56.8%) and equipment shortages (47.1%). On the other hand, three issues are of no concern to many dealers: housing market (57.5%), competition from box stores (39.1%) and manufacturer pressure for dealer purity (38.4%).

Rural equipment dealers seem to be more concerned about internal issues that directly impact their ability to operate a profitable business. External factors are of less concern. In an unpredictable environment, perhaps a more inward-looking posture is the right posture to take.