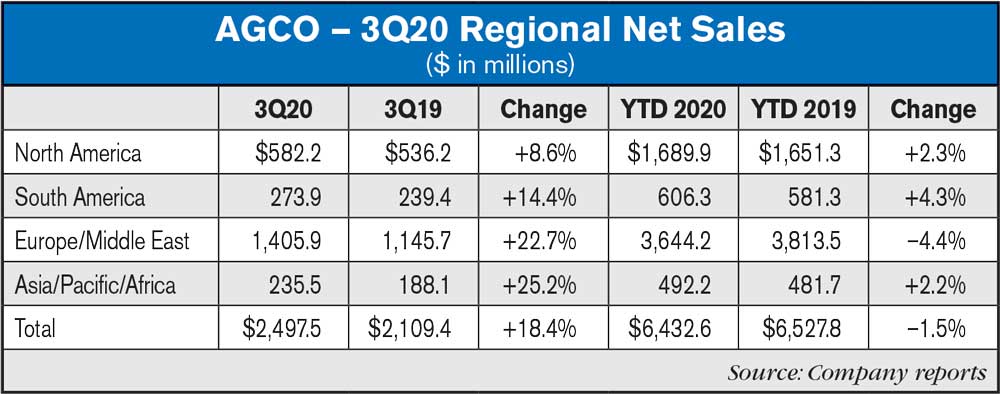

AGCO, a worldwide manufacturer and distributor of agricultural equipment and solutions, reported its results for the third quarter ended Sept. 30, 2020. Net sales for the third quarter were approximately $2.5 billion, an increase of approximately 18.4% compared to the third quarter of 2019. Excluding unfavorable currency translation impacts of approximately 1.6%, net sales in the third quarter of 2020 increased approximately 20% compared to the third quarter of 2019.

Net sales for the first nine months of 2020 were approximately $6.4 billion, a decrease of approximately 1.5% compared to the same period in 2019. Excluding unfavorable currency translation impacts of approximately 3.1%, net sales for the first nine months of 2020 increased approximately 1.6% compared to the same period in 2019.

Third Quarter Highlights

- Reported regional sales results (1): Europe/Middle East (“EME”) 22.7%, North America 8.6%, South America 14.4%, Asia/Pacific/Africa (“APA”) 25.2%

- Constant currency regional sales results (1)(2) : EME 18.9%, North America 9.1%, South America 48.5%, APA 21.3%

- Regional operating margin performance: EME 13.3%, North America 10%, South America 6.1%, APA 10.1%

- Year-to-date free cash flow increased over $309 million from the first 9 months of 2019

- Funding position improved with net debt below September 2019 levels

- Raised full-year outlook for net sales and net income per share

(1) Increase (decrease) as compared to third quarter 2019.

(2) Excludes currency translation impact. See reconciliation in appendix.

Industry Unit Retail Sales

| Tractors | Combines | |

| YTD 2020 | Change from Prior Year Period | Change from Prior Year Period |

| North America(1) | +7% | +1% |

| South America | +9% | +17% |

| Western Europe(2) | –5% | –4% |

(1) Excludes compact tractors

(2) Based on Company estimates

“Harvests are progressing ahead of schedule in the northern hemisphere and global crop production is on track for a record year despite the ongoing COVID-19 pandemic,” stated Martin Richenhagen, AGCO’s Chairman, president and chief executive officer. “Global grain consumption is recovering, consistent with improving economic activities and increased grain exports to China. Following reduced forecasts for ending grain inventories, soft commodity prices have risen in the third quarter, which is positive for farm economics.”

“Global industry demand for farm equipment is now expected to be relatively flat in 2020 versus 2019 with improved demand in North and South America offsetting lower demand in Europe,” continued Mr. Richenhagen. “Industry retail tractor sales in North America increased in the first 9 months of 2020 compared to the same period in 2019. Growth in the sales of low horsepower tractors was partially offset by weaker industry demand for high horsepower tractors. The fleet age for large equipment remains extended as replacement demand continues to be deferred in the North American market. Industry retail sales in Western Europe decreased in the first 9 months of 2020 due primarily to COVID-19 related production constraints. Market demand was weakest in the United Kingdom, France and Spain, and was partially offset by growth in Germany which has benefited from tax incentives during 2020. The negative impact of lower wheat harvests across most of Western Europe was mostly offset by stronger grain export demand and supportive wheat prices. European dairy and livestock fundamentals have stabilized after weakening earlier in the year. South America industry retail tractor sales increased during the first nine months of 2020, with growth in Brazil and Argentina partially offset by weaker demand in the smaller South America markets. Strong crop production in Brazil and Argentina, as well as favorable exchange rates are supporting positive economics. Farmers are replacing their aged fleet following years of soft demand due to economic weakness and challenging political environments.”

Regional Results

North America

AGCO’s North American net sales increased 3.1% in the first 9 months of 2020 compared to the same period of 2019, excluding the negative impact of currency translation. Increased sales of high horsepower tractors, hay equipment and Precision Planting products were partially offset by lower grain and protein product as well as sprayer sales. Income from operations for the first 9 months of 2020 improved approximately $69.4 million compared to the same period in 2019. Higher sales, the benefit of a richer mix of products, as well as cost control initiatives contributed most of the increase.

South America

Net sales in the South American region increased 30.4% in the first 9 months of 2020 compared to the first 9 months of 2019, excluding the impact of unfavorable currency translation. Increased sales in Brazil and Argentina were partially offset by lower sales in other South American markets. Income from operations in the first 9 months of 2020 was improved compared to the same period in 2019 by approximately $34.6 million. The improved South America results reflect the benefit of higher sales and production, a richer sales mix, as well as cost reduction initiatives, partially offset by negative currency impacts.

Europe/Middle East

AGCO’s Europe/Middle East net sales decreased 3.6% in the first 9 months of 2020 compared to the same period in 2019, excluding unfavorable currency translation impacts. Sales declines were driven primarily by lower production caused by the impacts from the COVID-19 crisis. All of AGCO’s major European production facilities were suspended due to supply availability from late March throughout most of April. Production and sales volumes increased substantially in the third quarter which offset a portion of the low second quarter output. Despite improved results in the third quarter, income from operations declined approximately $77.7 million in the first 9 months of 2020, compared to the same period in 2019, due to lower net sales and production volumes, partially offset by expense reductions.

Asia/Pacific/Africa

Asia/Pacific/Africa net sales increased 3.2%, excluding the negative impact of currency translation, in the first 9 months of 2020 compared to the same period in 2019. Higher sales in Australia and China were partially offset by declines in Africa and Southeast Asia. Income from operations improved by approximately $14.6 million in the first 9 months of 2020, compared to the same period in 2019, due to higher sales and a richer product mix in addition to reduced expenses.

Funding Update

AGCO’s available funding as of Sept. 30, 2020, including the $542.4 million term loan facility added during the second quarter, was approximately $1.6 billion consisting of cash of approximately $503.3 million and available borrowing capacity of approximately $1.1 million. The Company’s funding position improved during the third quarter with net debt approximately $323.3 million below September 2019.

Outlook

The health, safety and well-being of all AGCO employees, dealers and farmer customers continues to be AGCO’s top priority during the COVID-19 pandemic. The following outlook does not contemplate any further sales or production disruptions caused by the pandemic.

Net sales in 2020 are expected to be approximately $8.9 billion reflecting relatively flat end-market demand, the unfavorable impact of currency translation, offset by the benefit of positive pricing. Adjusted operating margins are expected to be improved from 2019 levels due to positive pricing and expense reductions.