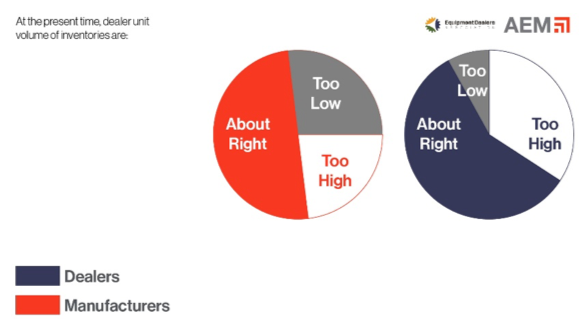

Comparing the dealer results of the AEM/EDA study to Ag Equipment Intelligence’s monthly Dealer Sentiments & Business Conditions Update survey shows the results of the two studies track fairly closely, at least when it comes of dealer inventories being “just about right.” The AEM/EDA results indicate that of the dealers surveyed showed almost 58% of dealers say their new equipment inventories are “about right.” The AEM press release didn’t offer any additional details of the dealers’ response beyond the “just about right” response.

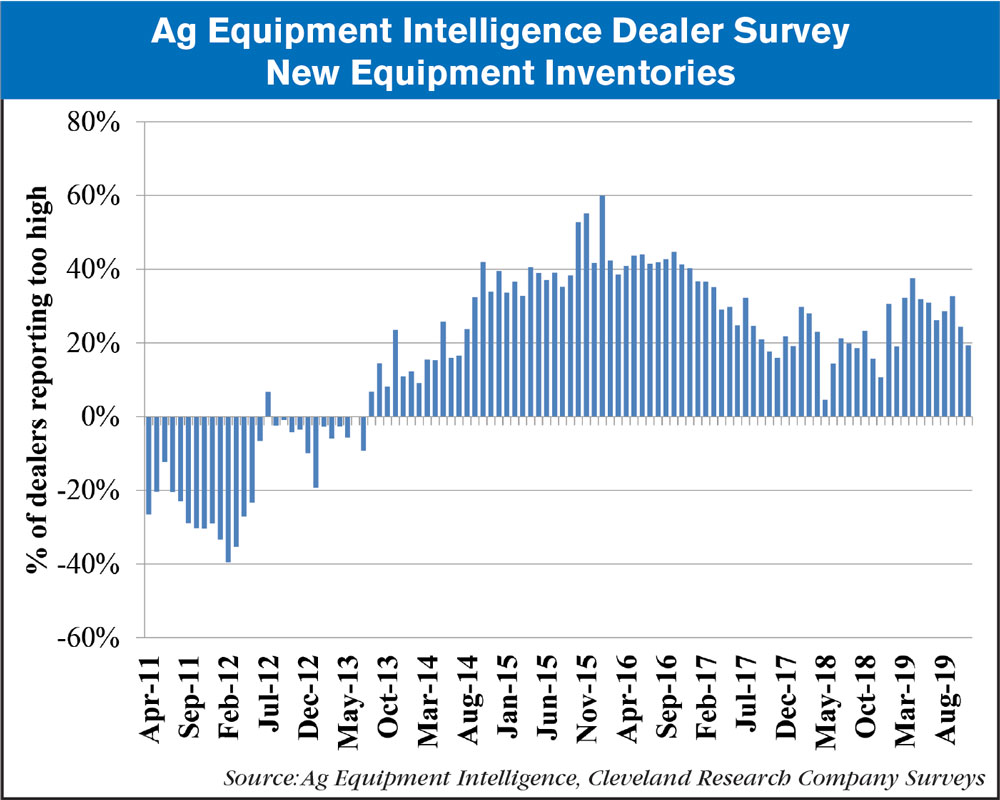

In the most recent Ag Equipment Intelligence survey of dealers (December 2019), 66% of dealers report that new equipment inventory levels improved in November with a net 19% of dealers reporting inventories too high (27% too high, 66% in line, 8% too low) vs. 24% of dealers reporting inventories too high (32% too high, 60% about right, 8% too low) in the previous month.

A building series of circumstances, from weather to trade policy, are putting downward pressure on the agriculture sector of the economy, however, ag equipment dealers and manufacturers believe dealer inventory levels are “about right,” and are primarily expecting flat results in the coming year.

According to the latest survey conducted by the Association of Equipment Manufacturers (AEM) and the Equipment Dealers Association (EDA), manufacturers and dealers are more in agreement on new-equipment inventory levels than they have ever been in the past. Half of manufacturers say dealer inventories of new equipment are “about right,” while almost 58% of dealers say the same. That reduces the amount of separation from last year’s already-record level of agreement by nearly half.

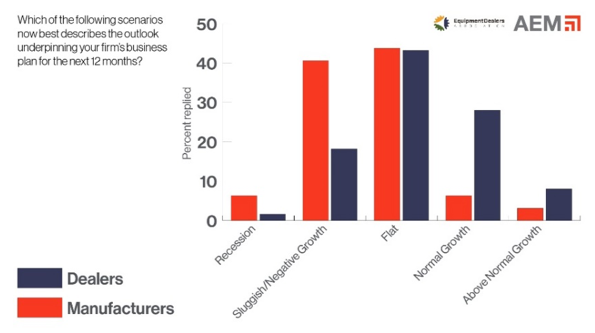

Meanwhile, roughly 43% of both groups are planning for a flat performance next year. From there, 36% of dealers are planning on normal growth or better, while about 9% of manufacturers say the same.

The reasoning for those disparities in thought may come from market exposure.

“The data shows manufacturers are noticeably more concerned about trade issues and economic performance globally, where economic data is showing headwinds especially in Europe and China,” said AEM senior VP of ag services Curt Blades. “Fortunately, the trade issue is one that can be controlled, and we’re optimistic U.S. and world leaders will resolve these disputes in the near future.”

“Ag equipment dealers are echoing the concerns of their clientele, the farmers,” said EDA VP of industry relations Joe Dykes. “Their biggest concern is the challenging weather conditions that have made planting and harvesting difficult and even impossible in some regions. Tariffs on end-user markets is their next largest concern, and you can see that especially in the dairy sector.”

Both manufacturers and dealers are looking to reduce costs to adjust to conditions, with dealers focusing on smaller equipment orders, and manufacturers focused on containing headcount.