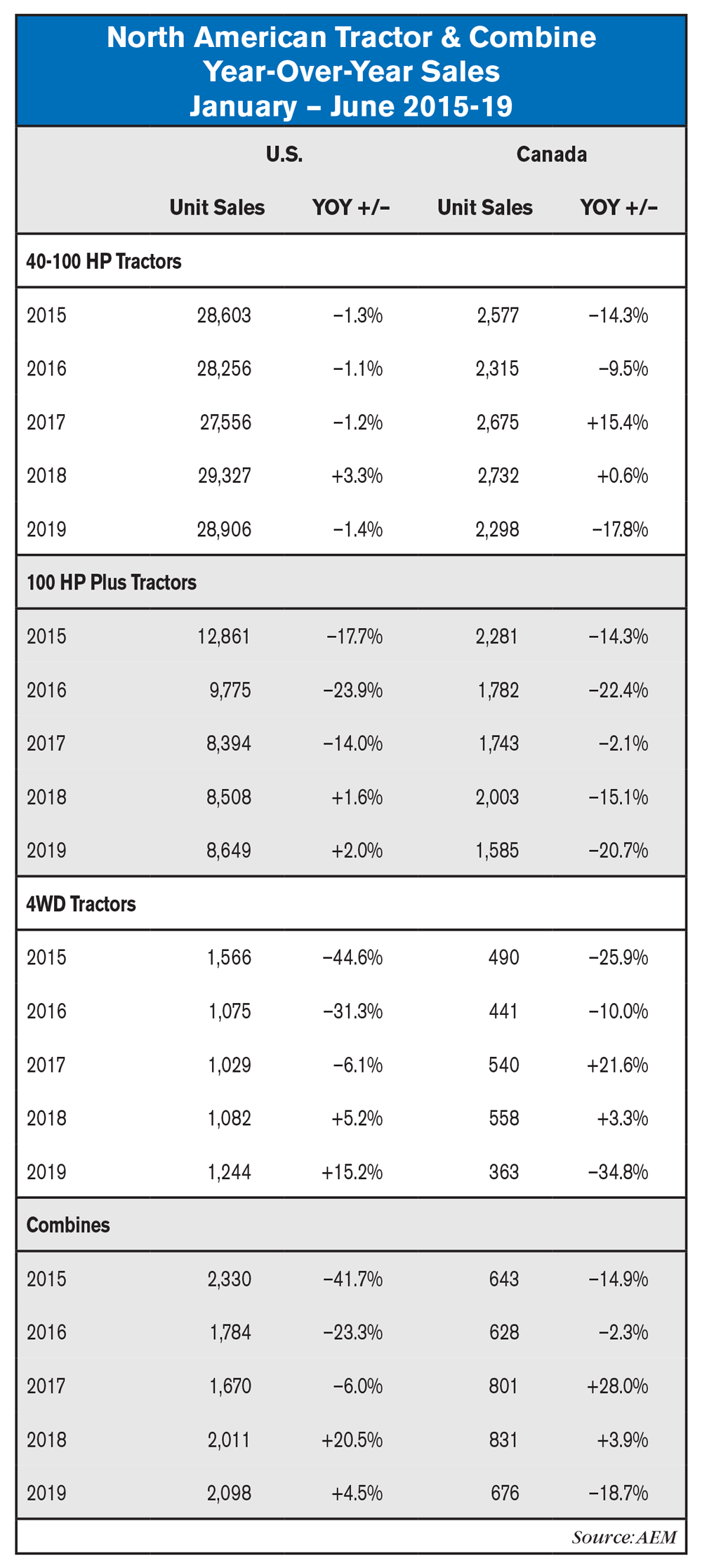

The numbers are in for the first half of the year and where you stand today depends on where you’re currently sitting. (See table below.)

According to the Assn. of Equipment Manufacturers’ (AEM) latest sales figures covering the first half of the year, U.S. retail sales of tractors and combines were, for the most part, positive. Only mid-size tractor sales during the first 6 months of 2019 showed a deficit (–1.4%) compared to the first 6 months of 2018. Sales of the other categories of tractors and combines all showed slight to strong growth: high horsepower tractors +2%; 4WD +15.2%; combines +4.5%.

This isn’t the case in Canada. The last solid first half of the year for Canadian dealers was 2017 when mid-size tractors sales were up by 15%, high horsepower equipment was down slightly (–2.1%), 4WD tractors were up 21.6% and combine sales grew by 28% vs. the first half of 2016. Since then it’s been a struggle to say the least.

Comments from Canadian dealers in Ag Equipment Intelligence’s July Dealer Sentiments & Business Conditions Update survey appear to support the AEM sales numbers.

“Current sentiment remains weak due to political concerns, lower than expected commodity prices and dry weather conditions.”

“Customers are still being very cautious about machinery purchases despite improved crop and growing conditions. We are seeing non-captive finance companies pulling back on equipment lending for the first time in 20 years.”

“We are trying to be more aggressive, but our manufacturer took away some programming on lower horsepower units.”

Rocky Mountain Dealerships (RME), is Canada’s largest agriculture equipment dealership group with Case IH, New Holland and Case Construction equipment as its primary lines of equipment. It released its second quarter earnings on July 31 and it wasn’t pretty. Ben Cherniavsky, analyst for Raymond James described it this way: “Having followed Rocky Mountain since its 2007 IPO, 2Q19 results looked to us to be about as close to ‘rock bottom’ as we have ever seen. Hammered by the ensuing agricultural trade disputes between Canada and China/India, the dealer's customers virtually went on a buyers' strike over the past few months … To be clear, much of this lies beyond management's control.”

It’s been tough sledding but let’s hope that this is indeed “rock bottom” for Canadian dealers and U.S. dealers can build on the little momentum they have going. Trade issues have created more uncertainty than normal for the agricultural industry in both the U.S. and Canada. They say you have to be an optimist to be a farmer. This is equally true for ag equipment dealers and equipment manufacturers. Hang in there baby!