The forecast for 2019 remains solid for the rural equipment market according to Rural Lifestyle Dealer’s 2019 Dealer Business Trends & Outlook Report.

Dealers zeroed in on what will boost revenues in 2019, with nearly 67% ranking zero-turn mowers number 1 of 26 categories. Tractors less than 40 horsepower ranked second with about 60% of dealers expecting unit sales to increase 2% or more. Utility vehicles ranked third (about 48% of dealers), rotary cutters ranked fourth (about 46% of dealers) and tractors 40-100 horsepower ranked fifth (about 40% of dealers) in terms of unit sales increases. (See the table “Product Lines with Most Potential to Increase Unit Sales” below.)

Consumer demand for zero-turn mowers continues to be strong as the category regularly tops the list. However, moderation is evident when comparing the top 5 this year with the top 5 last year (zero-turn mowers, tractors less than 40 horsepower, utility vehicles, rotary cutters and front-end loaders). The percentage of dealers expecting unit sales increases of 2% or more is down 5-10% among the top 5 categories.

Among the list of 26 categories, seeders/drills and power hand tools had the biggest shifts. Seeders/drills moved up to 18th place from 23rd place last year. Power hand tools moved up to 12th from 17th place. Manure spreaders also moved up in ranking (20th from 24th). Categories that declined in ranking for unit sales potential in 2019 include post-hole diggers (17th to 20th) and wood handling equipment (18th to 21st).

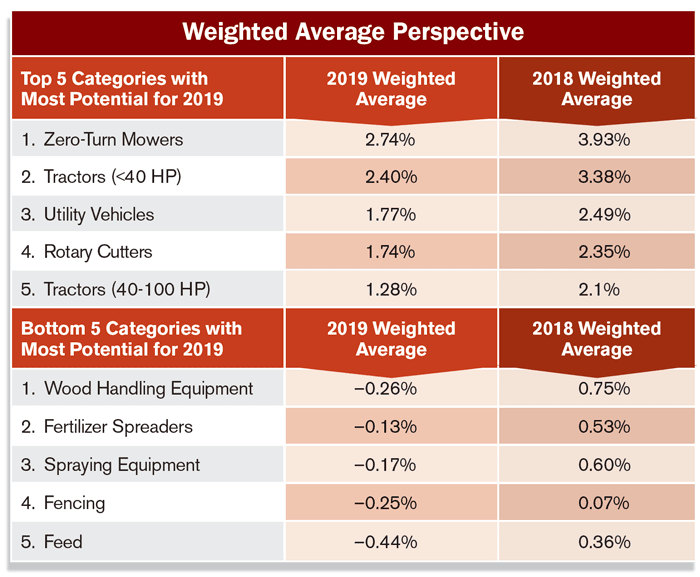

The weighted average perspective shows declines in the top 5 and bottom 5 for unit sales potential (comparing positive to negative forecasts). Zero-turn mowers showed the biggest decline from last year. (See the chart “Weighted Average Perspective” at the top.)

Expanding Lineups

A fresh showroom every season brings in customers and dealers are boosting their offerings of tractors for 2019. About 46% of dealers expect to add tractors in the under 40 horsepower category and more than 43% of dealers plan to add tractors in the 40-100 horsepower category. Utility vehicles ranked third (41% of dealers), zero-turn mowers ranked fourth (nearly 40% of dealers) and skid steer loaders ranked fifth (about 28% of dealers) in terms of products being added. (See the table “Product Lines Dealers are Likely to Add in 2019” below.)

Those same categories ranked in the top 5 for 2018, with the two tractor categories ranking above utility vehicles and zero-turn mowers for 2019. Last year’s top 5 ranking looked like this: utility vehicles, tractors less than 40 horsepower, zero-turn mowers, skid steer loaders and tractors 40-100 horsepower.

There was a good amount of shifting in the rest of the rankings. For instance, chain saws moved up to 9th from 15th last year; seeders/drills moved up to 11th from 19th; and ATVs ranked 16th this year and 22nd last year.

Categories that shifted lower this year in the rankings for products being added include finishing mowers (down to 21st from 7th); wood handling equipment (down to 22nd from 14th); and scrapers/graders (down to 24th from 18th last year).