SEGUIN, Texas — Alamo Group (NYSE: ALG) reported record net sales and net income for the third quarter and first 9 months for the period ended Sept. 30, 2018.

Highlights for the Quarter & 9 Months

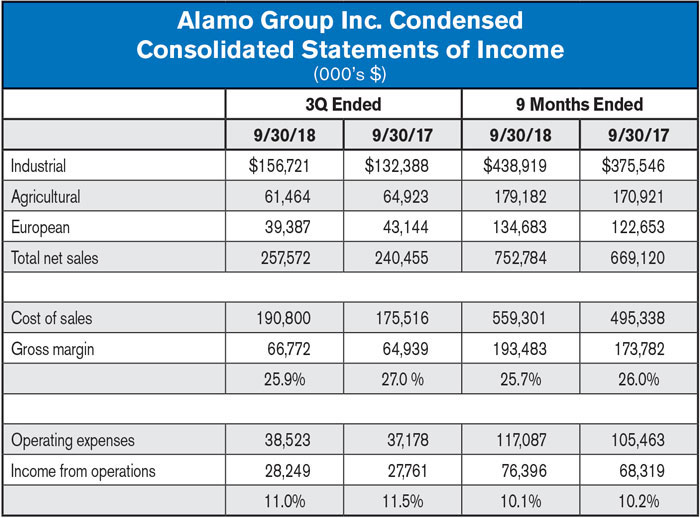

- Record net income for a third quarter of $23.5 million, up 41.9%

- Record net sales for a third quarter of $257.6 million, up 7.1%

- Industrial Division net sales of $156.7 million, up 18.4%

- Agricultural Division net sales of $61.5 million, down 5.3%

- European Division net sales of $39.4 million, down 8.7%

- Record net income for the first 9 months of $56.9 million, up 38.5%

- Record net sales for the first 9 months of $752.8 million, up 12.5%

- Backlog at $251.2 million, up 38.8% compared to the previous year’s third quarter

- 2018 third quarter and nine months results include a $3.0 million net tax benefit reflecting an adjustment to the charge taken in the fourth quarter of 2017 concerning U.S. tax reform

The company’s Agricultural Division net sales in the third quarter of 2018 were $61.5 million, compared to $64.9 million in the prior year, a decrease of 5.3%. The division’s income from operations for the quarter was $6.6 million compared to $8.6 million in 2017, a decrease of 23.1%. For the first 9 months of 2018, the Agricultural Division’s net sales were $179.2 million vs. $170.9 million in the prior year, an increase of 4.8%. Income from operations was $18 million in the first 9 months of 2018 compared to $19.3 million in 2017, a decrease of 6.6%. The division’s results for the first 9 months include the effects of the acquisition of Santa Izabel which contributed $9.7 million in net sales and $0.8 million in income from operations.

Regarding the ag division’s performance during the period, Ron Robinson, Alamo Group’s president and chief executive officer, commented, “We are concerned about the agricultural outlook which had been showing signs of strengthening, but now is faced with a backdrop of declining farm incomes and the impact that new tariffs are having on demand for certain agricultural commodities. Our Agricultural Division results, while off, are still good, primarily due to improvements in our operational efficiencies which helped mitigate the impact of higher input costs and lower sales.”

Robins added, “All in all, despite the various challenges, Alamo had a very good third quarter and 2018 is developing at a record pace. We believe some of the issues we are facing are unlikely to be resolved in the short term, such as the weakening agricultural market, but feel we are benefiting from an overall economy that is reasonably solid, as evidenced by the performance in our Industrial sector. And while tariffs and other cost increases have affected our results, in general, we feel we have been able to pass along some of these increases and should be able to maintain our margins through aggressive cost control measures.”