BLOOMINGTON, Minn.—(BUSINESS WIRE) The Toro Company (NYSE: TTC), a leading global provider of solutions for the outdoor environment, today reported results for its fiscal third quarter ended August 2, 2024.

“Our team executed with discipline and delivered top- and bottom-line growth in a very dynamic environment,” said Richard M. Olson, chairman and chief executive officer. “We achieved substantial growth in our residential segment driven by our strong mass channel, as expected following aggressive destocking last year, and the strategic addition of Lowe’s this year. For our professional segment’s underground construction, and golf and grounds businesses, we successfully drove increased output and shipments to address the sustained demand and elevated order backlog. In both segments, we saw increased caution from homeowners and lawn care dealers as summer progressed due to macro factors, which resulted in lower-than-expected shipments of residential and professional lawn care products to our dealer channel. Even so, we continued to make significant progress in reducing dealer field inventories of those products.

“Throughout the quarter, we advanced our enterprise strategic priorities, including driving productivity and operational excellence. We are already realizing benefits from our multi-year productivity initiative named AMP, and we expect these benefits to accelerate during the next two years. We remain on track to deliver at least $100 million in annualized run rate savings by fiscal 2027. It remains our intention to reinvest a portion of the savings, to fuel our technology transformation and profitable growth, and drive long-term value for our shareholders."

Outlook

“Our business fundamentals remain strong, and we continue to execute with discipline,” added Olson. “For our professional segment, the demand drivers in our underground construction and golf businesses remain compelling. The projected strength in infrastructure spending for the foreseeable future is a positive outlier in the construction industry, and golf rounds played show no signs of slowing down. For these businesses, the healthy pace of orders has continued to keep backlog elevated and, as such, we are driving increased output to improve lead times. For lawn care products, we expect a heightened level of macro uncertainty will continue to drive near-term caution. Importantly, we have made significant progress in reducing our dealer field inventories of lawn care products and expect to exit the fiscal year in a much better position than last year. We expect enduring benefits from the investments we’ve made in our innovative product line-up, and from the strategic development of our independent dealer networks and mass partnerships.

“We are extremely well positioned in attractive end markets, and look ahead with optimism to fiscal 2025 and beyond. Our team remains laser focused on operating with agility and discipline, driving productivity across the enterprise, and capitalizing on our innovative product portfolio to drive value for our customers, channel partners and shareholders,” concluded Olson.

For fiscal 2024, the company now expects total company net sales growth of about 1%, and *adjusted diluted EPS in the range of $4.15 to $4.20. This guidance is based on current visibility and assumes:

- a continuation of macro factors that have driven increased consumer and channel caution;

- continued strong demand and stable supply for our underground construction, and golf and grounds businesses; and

- weather patterns aligned with historical averages for the remainder of the year.

This guidance also considers:

- remaining adjustments needed to normalize field inventory levels of lawn care products and snow and ice management solutions;

- manufacturing inefficiencies as production and inventory levels continue to be adjusted to market conditions; and

- the net impact across all residential mass channel partners related to our new strategic partnership with Lowe's.

Third-Quarter Fiscal 2024 Segment Results

Professional Segment

- Professional segment net sales for the third quarter were $880.9 million, down 1.7% from $896.3 million in the same period last year. The decrease was primarily driven by lower shipments of snow and ice management products, lawn care equipment, and compact utility loaders, partially offset by higher shipments of golf and grounds products, and underground construction equipment, along with net price realization.

- Professional segment earnings for the third quarter were $165.7 million, up from $13.0 million in the same period last year, and when expressed as a percentage of net sales, 18.8%, compared to 1.5% in the prior-year period. The increase in profitability was primarily due to prior-year non-cash impairment charges of $151.3 million, productivity improvements, product mix, and net price realization, partially offset by higher material and manufacturing costs and lower net sales volume.

Residential Segment

- Residential segment net sales for the third quarter were $267.5 million, up 52.6% from $175.3 million in the same period last year. The increase was primarily driven by higher shipments to our mass channel.

- Residential segment earnings for the third quarter were $32.6 million, up from $3.8 million in the same period last year, and when expressed as a percentage of net sales, 12.2%, up from 2.2% in the prior-year period. The year-over-year increase was largely driven by net sales leverage, productivity improvements, and net price realization primarily due to lower floor plan costs, partially offset by product mix and higher material and manufacturing costs.

OPERATING RESULTS

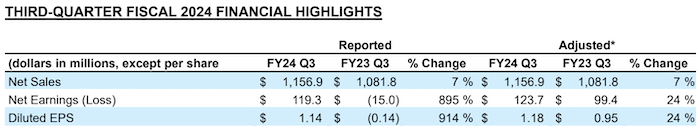

Gross margin and *adjusted gross margin for the third quarter were 34.8% and 35.4%, respectively, up from 34.4% for both in the same prior-year period. The increase was primarily due to productivity improvements and net price realization, partially offset by higher material and manufacturing costs and product mix.

SG&A expense as a percentage of net sales for the third quarter was 22.0%, compared with 22.2% in the prior-year period. The improvement was primarily driven by net sales leverage and lower marketing costs, partially offset by higher incentive expenses.

Operating earnings as a percentage of net sales were 12.8% for the third quarter, compared with (1.8)% in the same prior-year period. *Adjusted operating earnings as a percentage of net sales for the third quarter were 13.7%, compared with 12.2% in the same prior-year period.

Interest expense was $14.5 million for the third quarter, down $0.5 million from the same prior-year period. This decrease was primarily due to lower average outstanding borrowings.

The reported effective tax rate for the third quarter was 17.3%, compared with 47.6% in the same prior-year period, primarily due to the tax impact related to non-cash impairment charges last year and a more favorable geographic mix of earnings this year. The *adjusted effective tax rate for the third quarter was 18.0% compared with 19.0% in the same prior-year period, primarily due to a more favorable geographic mix of earnings.