Even as inventories rise and interest rates remain high, rural lifestyle dealers are maintaining healthy optimism as they begin the year. According to the 2024 Rural Lifestyle Dealer Business Trends & Outlook report, their revenue forecasts are improved year-over-year in wholegoods, parts and service revenue. They beat the somewhat pessimistic wholegoods sales forecast for 2023 that came with last year’s report. Confidence in zero-turn mower sales in particular remains high.

Dealers have acknowledged the challenges, however. They are reporting fewer wholegoods turns than they did in 2022. How interest rates will impact customer decisions, the rising price of new equipment and the still ongoing tech shortage remain top concerns. And fewer dealers are planning to increase their capital expenditures in modernizing their retail space and shops for 2024.

Overall, however, dealers’ operations and spirits appear in good health heading into what will likely be a challenging year.

Revenue Forecasts Improve

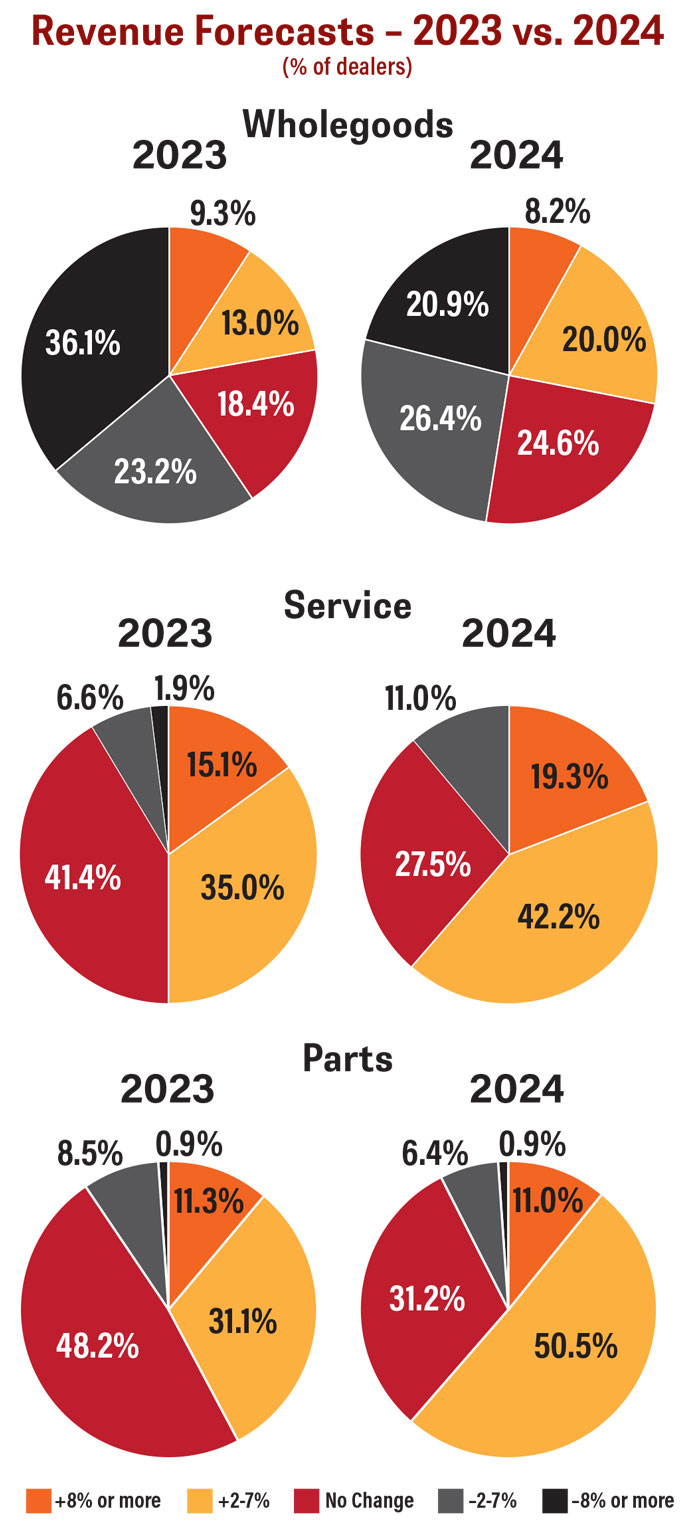

Looking at 2024, dealers are slightly more optimistic than they were heading in 2023 but are still negative overall. For this year, 28.2% of dealers are forecasting a wholegoods revenue growth of 2% or more vs. 22.3% who said the same for 2023 in the previous report. At the same time, almost half of surveyed dealers (47.3%) are forecasting a wholegoods revenue decline of 2% or more, with 20.9% forecasting a decline of 8% or more. This is, however, less than the 59.3% who had forecast a decline for 2023.

Service revenue outlooks were once again positive overall, with 61.5% of dealers forecasting it to increase in 2024, above the 50% who had said the same for 2023. Additionally, the percentage forecasting a service revenue increase of 8% or more rose year-over-year from 15.1% to 19.3%. Looking at negative service revenue forecasts, the percentage anticipating a decline of 2% or more did increase year-over-year from 8.5% to 11%. However, no dealers forecast a service revenue decline of 8% or more in 2024.

Parts revenue projections were also positive for 2024, with 61.5% of dealers forecasting an increase of 2% or more vs. 42.4% who had forecast the same for 2023. 11% of dealers are forecasting 2024 parts revenue up 8% or more year-over-year. Just 7.3% of dealers are forecasting parts revenue to decline 2% or more in 2024 vs. 9.4% who had forecast the same for 2023.

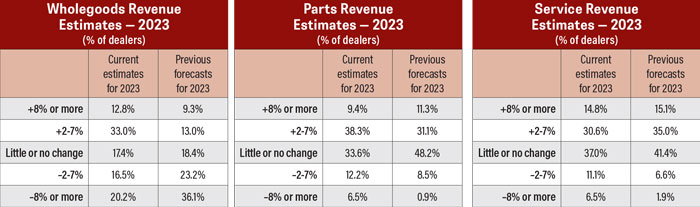

2023 Revenue Estimates vs. Forecasts

Beginning this year, rural lifestyle dealers were asked to estimate their revenue in the current year (when the survey was taken). For 2023, 45.8% of dealers estimated their wholegoods revenue was up 2% or more year-over-year, beating previous year expectations when only 22.3% forecast an increase. Most of that increase came in the 2-7% range, which rose from 13% to 33%. Additionally, the percentage estimating wholegoods revenue down 2% or more came in at 36.7%, below the 59.3% who had forecast a decline in the previous report. Most of that decline came in the 8% or more category, which fell from 36.1% to 20.2%.

For parts revenue, a larger percentage of dealers estimated their parts revenue up in 2023 than had forecast it up previously. Some 47.7% of dealers are estimating their 2023 parts revenue was up year-over-year vs. 42.4% who forecast an increase in the last report. However, fewer dealers estimated an increase of 8% or more (9.4%) than forecast it previously (11.3%). Additionally, a larger percentage of dealers estimated their 2023 parts revenue had declined 2% or more (18.7%) than had forecast that in the last report (9.4%). Among those forecasting a decline, 6.5% estimate their 2023 parts revenue was down 8% or more year-over-year.

Dealers Comment on Inventory Management in 2024

When giving their thoughts in this year’s Business Trends & Outlook survey on how they’ll manage inventory in 2024, dealers’ mostly pointed to taking a conservative approach.

One dealer said they are approaching inventory planning very carefully, saying, “As inventory availability increased, manufacturers flooded our lot, and we have too much inventory now. I am planning inventory for 2024 on the side of being cautious and then possibly having to do restocking orders.”

Another dealer pointed to consumers being put off by high prices, saying, “Prices have increased so much in the past few years that people are just pulling back, saying no to the inflated prices. You would think because of the higher new prices, the used price should go up. Those people who would normally purchase used are saying no to the higher used prices. There will be a bottleneck for sure. All the large mega dealers are having auctions to liquidate used inventory and losing record dollars.”

Several dealers pointed to frustration with their OEMs, with one dealer saying, “New Holland is batch building and shipping a 2-year supply of inventory of one model. Dealers don’t need a 2-year supply of anything. They didn’t learn anything during COVID.”

Another said of their suppliers, “We are looking closely at inventory levels and canceling units where inventory is starting to build up. Suppliers had everyone order 2-3 year supply, and we canceled a lot before they shipped the units to keep our inventory levels in check.”

Still, some dealers aren’t as concerned. One dealer simply said, “Full speed ahead. You can’t sell it if you don’t have it.” Another mentioned that while inventory levels are up, they still haven’t reached 2016 levels. Some simply said they will treat this year’s inventory as any other year, and several dealers said they are focusing more on turns.

One dealer commented on how 2024 stocking is a total reversal from 2020, saying, “Limited show and go inventory, units are stacking up and carrying costs are cutting into the feasibility of going wide and deep on stocking products. If it’s a low sales ‘nice to have’ item, we just can’t stock them right now, we have to focus on turns and get back to either selling what’s in stock or have customers wait for an order. It’s like the table turned on 2020, now instead of the customer having to wait for an order because we can’t get enough, they have to wait because we don’t want to hold that much.”

For service revenue, dealers estimate they did not beat forecasts. Just over 45% of dealers estimate their service revenue was up in 2023 vs. 50.1% forecasting the same in the last report. Another 17.6% estimate their 2023 service revenue was down at least 2%, above the 8.5% who had forecast the same decline for 2023.

The percentage of dealers reporting their business was profitable in 2023 came in at 81%, down from the 94.3% in 2022.

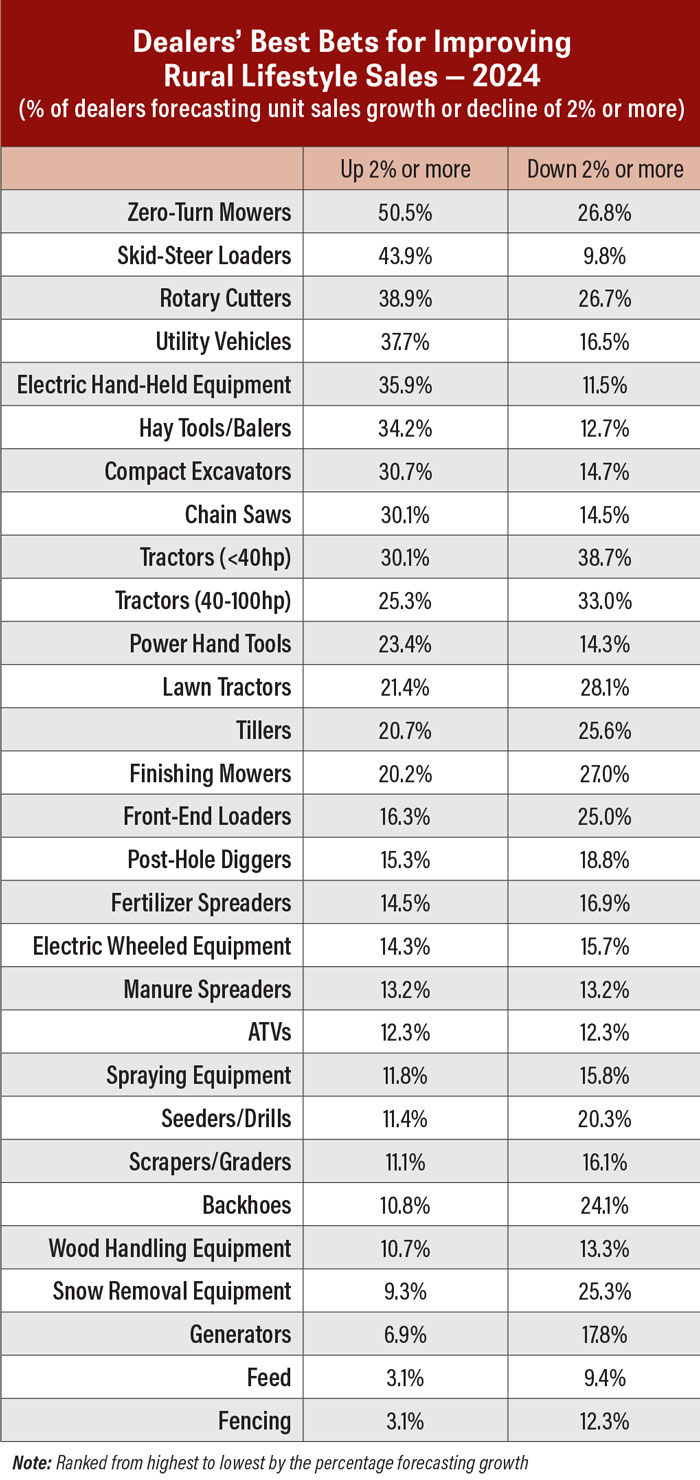

Best Bets for Wholegoods Sales Improvements

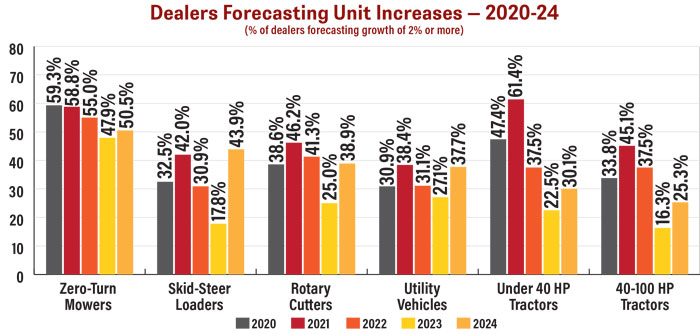

When asked which equipment they saw at their “best bets” for improving unit sales in 2024, over half of dealers forecast their zero-turn mower sales up 2% or more, making it the #1 pick for 2024. However, another 26.8% of dealers forecast their zero-turn mower sales down for 2024. Other equipment segments with a higher percentage of dealers forecasting growth were skid-steer loaders (43.9%), rotary cutters (38.9%), utility vehicles (37.7%) and electric hand-held equipment (35.9%). Fencing and feed had the lowest percentage of dealers forecasting growth for 2024 at 3.1%.

The category with the highest percentage of dealers forecasting a decline was under 40 horsepower tractors at 38.7%. This was followed by 40-100 horsepower tractors at 33% and lawn tractors at 28.1%.

The percentage of dealers forecasting unit sales growth for zero-turn mowers was up year-over-year from 47.9%, but remains below the 5-year peak of 59.3% that forecast an increase for 2020. This percentage had declined for 3 years in a row prior to the most recent report.

Skid-steer loaders had the highest percentage of dealers forecasting unit sales growth seen in the last 5 years in the latest report, up from just 17.8% who forecast unit sales growth for 2023.

With 38.9% of dealers forecasting growth for 2024, rotary cutter sales forecasts have returned to pre-pandemic levels, when 38.6% of dealers were forecasting unit sales growth for 2020.

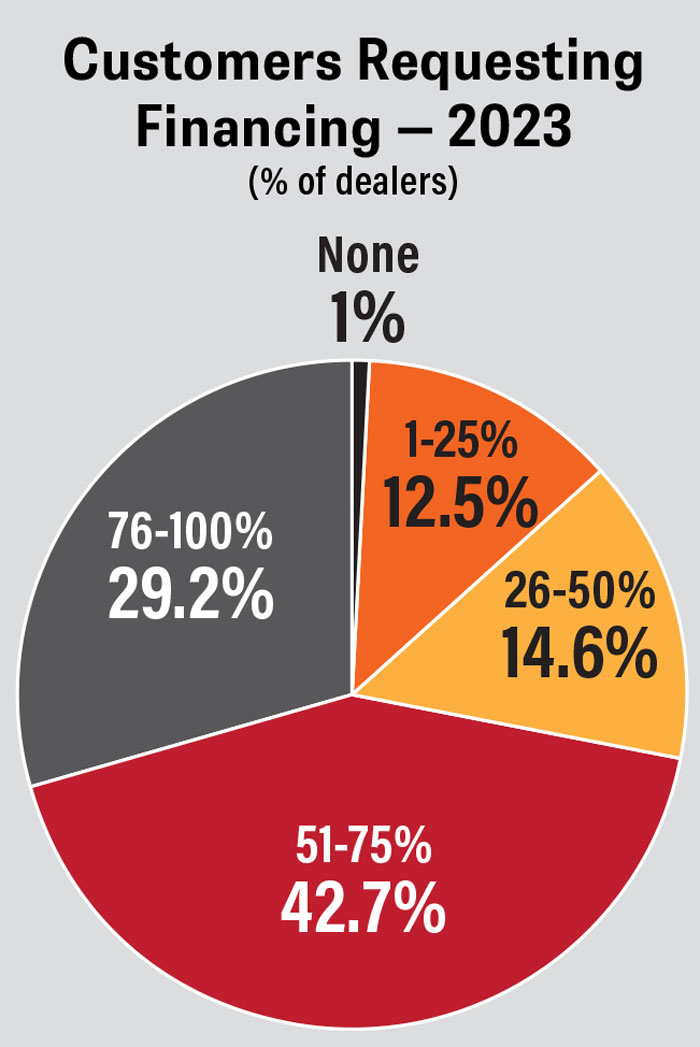

According to surveyed dealers, 71.9% said customers ask them for financing at least 51% of the time. Among that percentage, 29.2% of dealers say their customers ask for financing at least 76% of the time. Source: Rural Lifestyle Dealer Business Trends & Outlook surveys

37.7% of dealers are forecasting UTV unit sales up in 2024, up from 27.1% who forecast the same for 2023. This percentage peaked for 2021, when 38.4% of dealers forecast unit sales increases.

Looking at compact tractors, just over 30% of dealers are forecasting a sales increase for 2024, half the 61.4% who had forecast a sales increase for 2021, which was a 5-year high. The percentage of dealers forecasting a unit sales increase hit a 5-year low in 2023 (22.5%).

Utility tractor sales saw a similar trend, with the percentage of dealers forecasting unit sales increases up year-over-year to 25.3%. This percentage also peaked in 2021 when 45.1% of dealers were forecasting unit sales to improve.

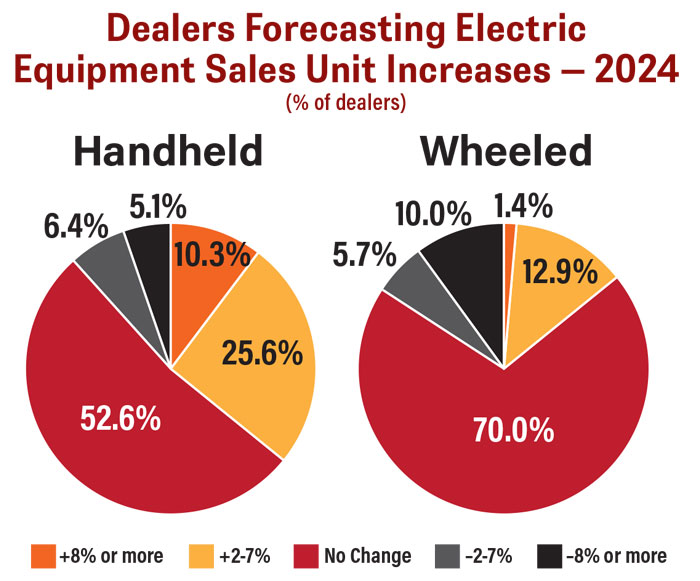

This year was the first time dealers were asked to give forecasts for electric handheld and wheeled equipment. Attitudes toward handheld electric equipment was more positive, with 35.9% forecasting a unit sales increase of 2% or more and just 11.5% forecasting a decline. For wheeled equipment, 14.3% forecast an increase in sales in 2024 and another 15.7% forecast a decline.

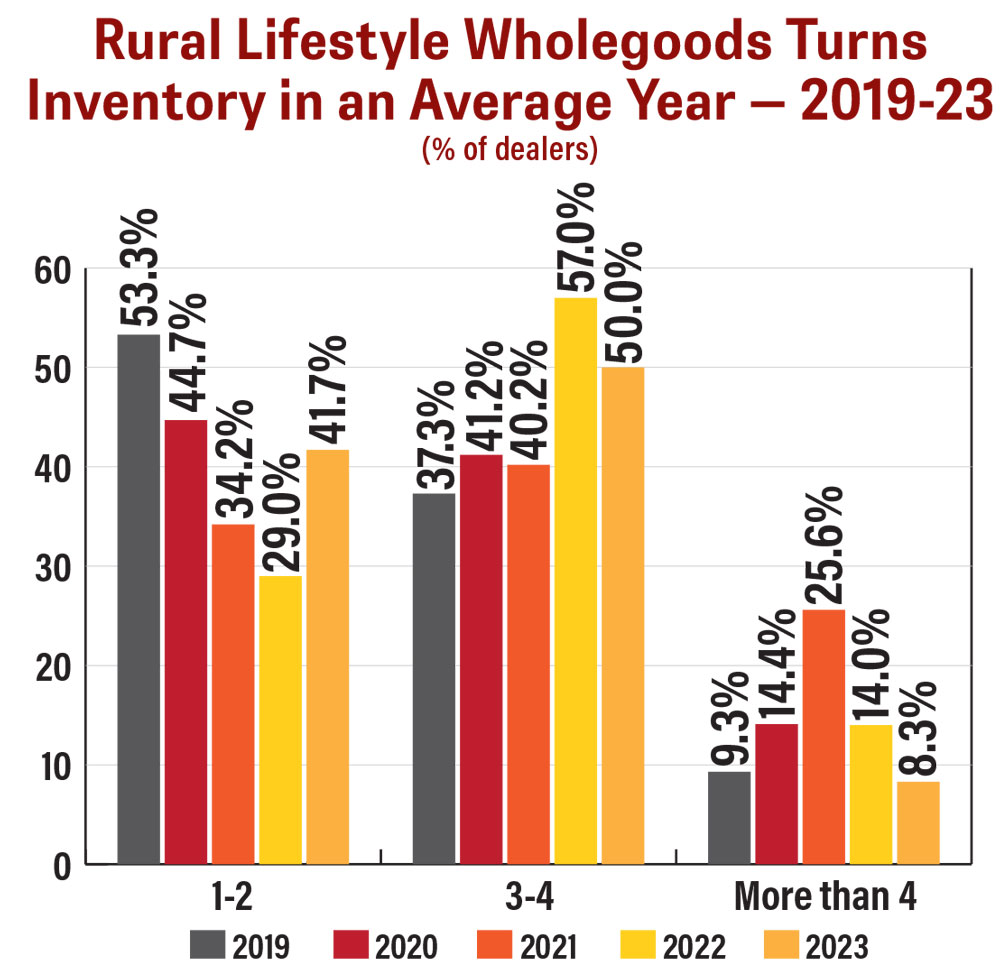

Looking at wholegoods turns, dealers are trending down toward the 1-2 turn category, which came in at 41.7% vs. 29% last year. At the same time, the percentage of dealers turning wholegoods more than 4 times dropped for the second year in a row to 8.3% from a peak of 25.6% in 2021. Half of dealers reported they are turning their wholegoods 3-4 times. Results in the latest report, however, are still improved from the pre-pandemic data (2019), when over half of dealers were turning their wholegoods 1-2 times.

Techs & Shop Rates

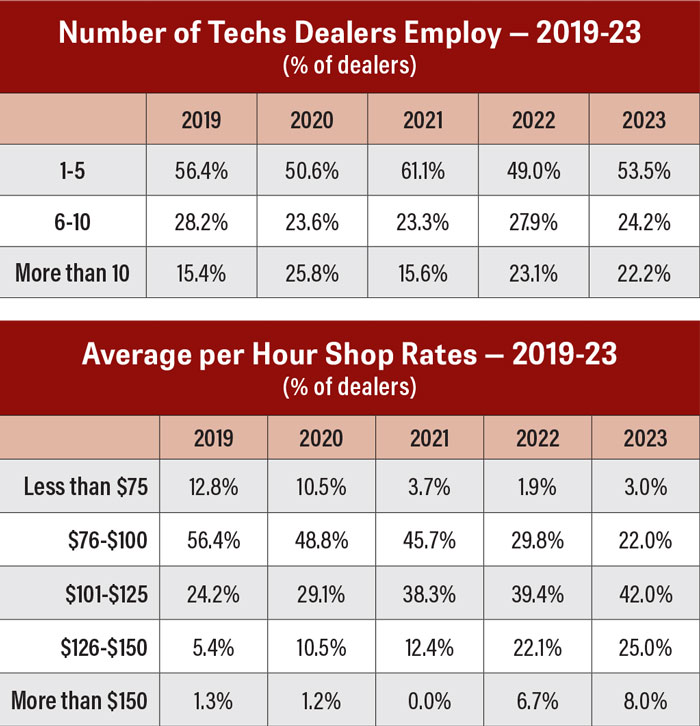

Over half of surveyed dealers reported employing 1-5 techs at their store, up from 49% in the previous report. This percentage hit a 5-year high in 2021 at 61.1%. That same year, 15.6% of surveyed respondents had more than 10 techs at their store, which rose to 22.2% in the latest survey results.

This year’s report saw dealers continue to trend toward higher shop rates. The highest percentage (42%) of dealers are charging $101-$125 per hour, up from 39.4% in the last report and a 5-year high. The percentage of dealers charging $126-$150 (25%) and more than $150 per hour (8%) were also up year-over-year and hit 5-year highs. 22% of dealers reported charging $76-$100 per hour, down from 29.8% in the last report and the fourth year in a row this percentage declined.

Top Concerns

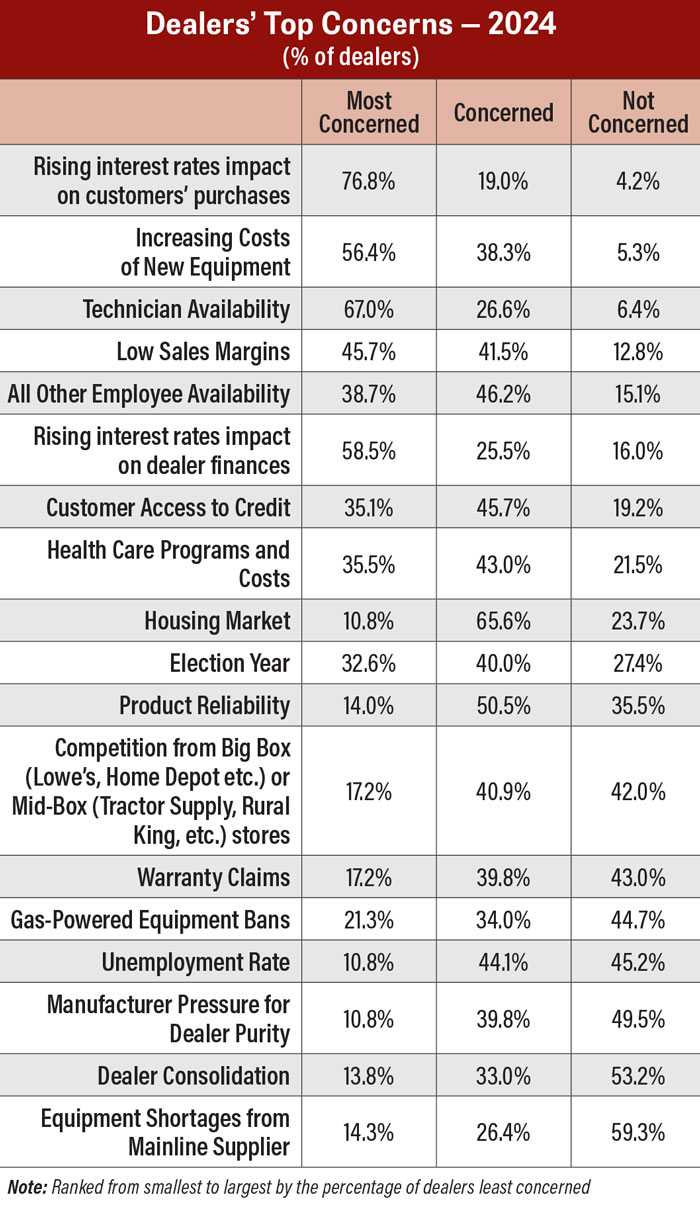

Dealers’ top concern for 2024 (measured by how few dealers are “least concerned”) was the impact rising interest rates will have on customer purchases. On this issue, 76.8% of dealers are “most concerned” and 19% are “concerned.” This was also the issue with the highest percentage of dealers saying they are most concerned.

The increasing cost of new equipment followed with 94.7% of dealers being concerned or most concerned and technician availability at 93.6%. How interest rates might impact dealers’ operations was the #6 concern, with 84% of dealers concerned or most concerned.

Dealers are least concerned about equipment shortages from their mainline suppliers, with 40.7% of dealers saying they are concerned or most concerned about the issue. Other categories of low concern to dealers are dealer consolidation (53.2% of dealers not concerned) and manufacturer pressure for dealer purity (49.5% not concerned).

The fact that 2024 is an election year saw 72.6% of dealers concerned or most concerned.

Brands & Products

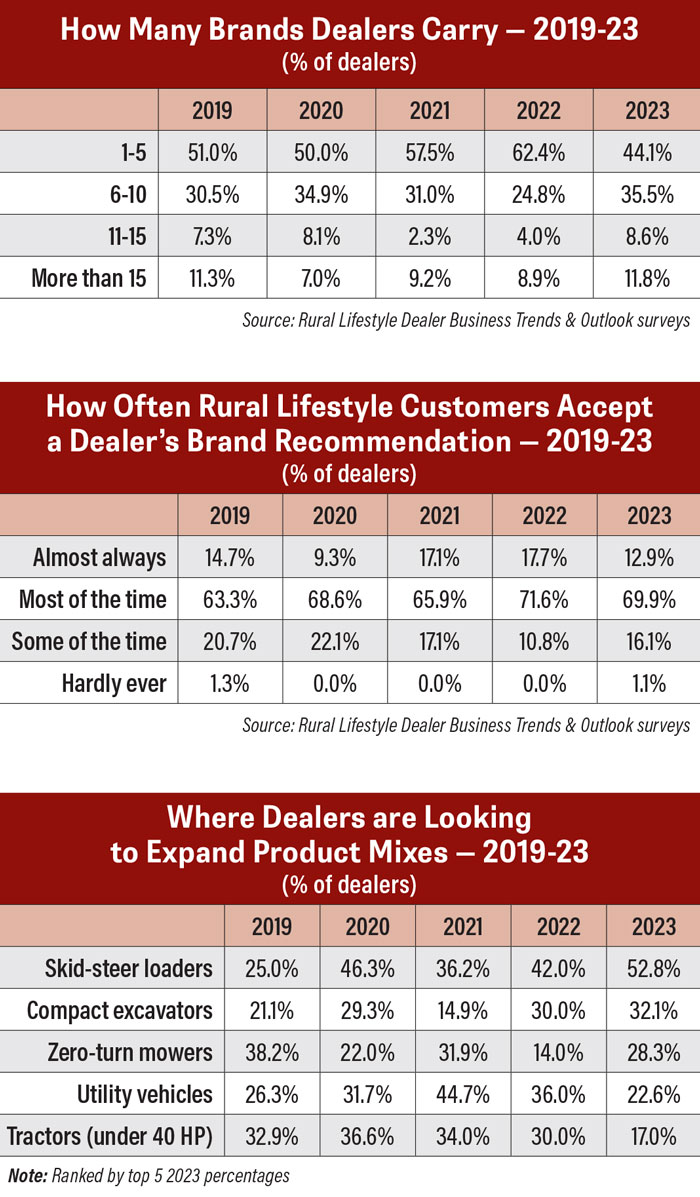

This year’s report saw dealers trending toward carrying more brands. The percentages of dealers carrying 6-10 brands (35.5%), carrying 11-15 brands (8.6%) and carrying more than 15 brands (11.8%) were all up year-over-year and all reached 5-year highs. Just over 44% said they carry 1-5 brands, down year-over-year and the lowest this percentage has been in 5 years.

Note: Ranked from smallest to largest by the percentage of dealers least concerned Source: Rural Lifestyle Dealer Business Trends & Outlook surveys

The majority of dealers (62.4%) still say their customers have a brand or unit in mind most of the time when they come into the dealership, and this number hit a 5-year high in the latest results. The percentage saying customers almost always have a brand or unit in mind dropped from 12.6% to 8.6%. Additionally, fewer dealers (26.9%) said their customers only have a specific product in mind some of the time than did in the previous report (35%).

Dealers also indicated customers are leaning away from their recommendations slightly. Almost 13% of dealers say customers almost always take their brand recommendation, down from 17.7%. The percentage saying they take the recommendation most of the time also dropped slightly from 71.6% to 69.9%. Most of that decline went to the “some of the time” category, which rose year-over-year from 10.8% to 16.1%.

When asked where they’re looking to expand their product mixes, the most popular category for 2024 was skid-steer loaders at 52.8% of dealers. This was up year-over-year from 42% who said the same in the previous report. Compact excavators was the second-most selected option (32.1% of dealers) and zero-turn mowers followed at 28.3%.

Almost 23% of dealers are looking to expand their UTV product mix, the fourth-most selected option in the latest report but down year-over-year for the second year in a row. 17% of dealers are looking to expand their under 40 horsepower tractor product mix, down from 30% in the last report.

Almost 42% of dealers expect to add an equipment line in the next 2 years, up from 32% who said the same in the last report but slightly below the 5-year peak of 42.1% seen in 2021.

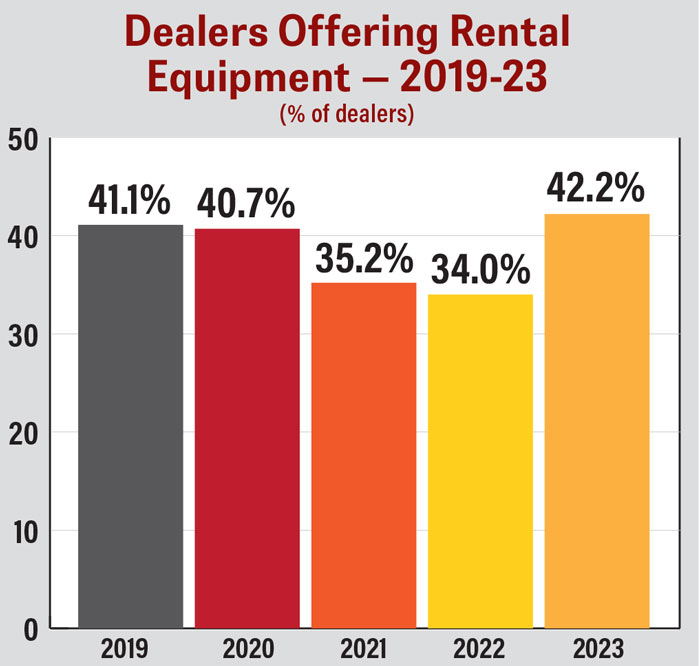

Just over 42% of dealers said they offer rental equipment, up from 34% who said the same in last year’s report and the highest percentage seen in the last 5 years. Source: Rural Lifestyle Dealer Business Trends & Outlook surveys

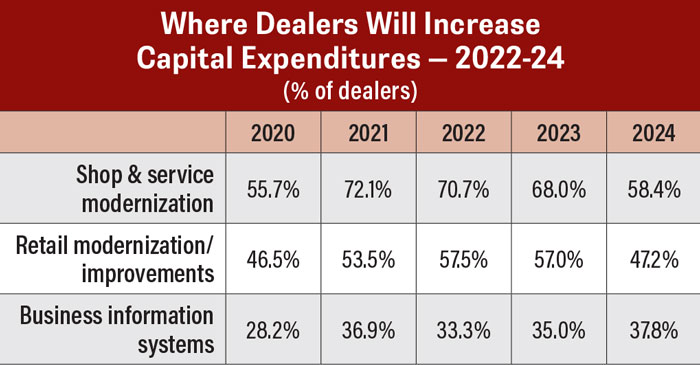

This year’s report saw fewer dealers planning on shop and retail improvements. 58.4% of dealers said they will increase investments to modernize their shop in 2024, down from 68% who had said the same about 2023. This percentage has been on the decline since peaking for 2021 at 72.1%. Another 47.2% of dealers said they’ll bump up capital expenditure to modernize their retail space in 2024, also down year-over-year.

Where dealers plan to increase capital expenditure for 2024 is their business information systems, where 37.8% said they’ll increase investments. This is a 5-year high and the second year in a row this percentage has increased.