Recent survey results show that landscape contractors’ appetite for purchasing power equipment has improved during the last quarter. Seaport Global Securities (SGS), which conducted the survey of landscape industry participants, reports that 41% of landscapers plan to spend more on power equipment in 2017 compared to 2016. In its previous survey 3 months earlier, only 33% indicated they were planning to increase their equipment expenditures this year.

“The ratio of increased capex plans vs. reduced capex plans increased to 2.8x from 2.4x 3 months ago,” says Michael Shlisky, analyst for SGS, in a note.

“While the revenue outlook appears to have ticked down for the sector, with 56% of landscapers expecting growth of 5% or more in 2017 vs. 70% 3 months ago, the vast majority of participants continue to expect revenue growth, and this appears to have led to an improvement in purchase-intention readings for power equipment,” says Shlisky. “We view the results as a positive for companies we cover that serve the landscaping/lawn and garden industry.”

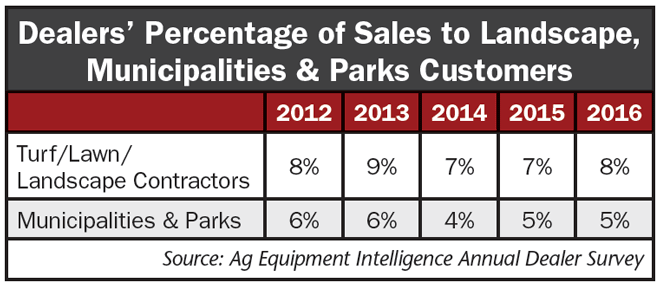

The landscape/turf care and municipalities and parks sales are significant for equipment dealers serving this customer segment. According to Ag Equipment Intelligence’s annual Dealer Business Outlook & Trends survey, since 2012 revenue from this part of their business has averaged 12-15% of total sales.

According to Shlisky, business growth and equipment replacement are the most significant drivers for landscape contractors to increase equipment spending. “Much like last quarter’s survey, the two main drivers of equipment budgets were a growing business (45% of respondents cited this as a reason for capex), and regular replacement (48% cited this). In this quarter’s survey, we saw an increase of participants expecting to replace equipment faster (17%) in order to offset or reduce fuel and labor costs, compared to 8% 3 months ago.”

He also noted that overall sentiment among landscapers continues to improve. “Among the respondents to our survey, 35% told us that they feel better about their business today than 3 months ago. About 9% feel worse about their business than 3 months ago, with the remainder noting that sentiment was unchanged.”

Golf Courses Plan Modest Capex Increases in 2017

Capital expenditures by golf courses are expected to rise during the remainder of 2017, according to results of Seaport Global Securities’ most recent survey of 50 golf courses.

“Purchase intention readings from our survey suggest that 2017 power equipment and maintenance budgets have improved modestly vs. last quarter’s survey, with 26% of respondents expecting to spend more on equipment this year vs. last, while 20% plan to reduce power equipment spending,” says Michael Shlisky, analyst with SGS. “This compares to 23% increasing and 32% reducing in last quarter’s survey.”

The universe of dealers handling the type of equipment used to maintain golf courses is fairly limited. At the same time, dealers with their foot in the door of the golf industry have found it to be very lucrative because of the specialized machines required.

According to Shlisky, survey results also improved from last quarter’s favorable trends on course maintenance budgets, including large projects, as well as irrigation maintenance. “Golf courses remain fairly optimistic on revenue expectations; 61% of courses expect 2% growth or more in revenues in 2017, down slightly from last quarter’s 66%; the slight decline in expectations was driven by greens fees, while other areas such as membership fees and food and beverage were close to flat,” he says.